When Sarah Martinez opened her boutique marketing agency in Austin, Texas, she thought managing finances would be straightforward. Six months later, she found herself drowning in receipts, struggling with tax deadlines, and losing sleep over cash flow projections. Her story isn’t unique—thousands of business owners across America face the same challenge every day. The solution? Professional bookkeeping services that transform financial chaos into organized, actionable data.

Finding the right book keeping services in the USA can mean the difference between business success and financial disaster. Whether you’re a startup founder, an established enterprise, or a financial professional serving multiple clients, understanding where to find quality bookkeeping support is crucial for sustainable growth in 2025.

Key Takeaways

- Professional bookkeeping services range from local firms to national providers, each offering unique advantages based on your business size and industry

- Book keeping software has revolutionized the industry, enabling remote services and real-time financial visibility for businesses nationwide

- Specialized bookkeeping providers exist for specific industries, from e-commerce to healthcare, offering tailored expertise

- The best bookkeeping services combine technology, qualified professionals, and responsive customer support

- Costs vary significantly based on transaction volume, business complexity, and service level, making comparison essential

Understanding the Bookkeeping Services Landscape in 2025

The bookkeeping industry has undergone massive transformation over the past decade. Traditional brick-and-mortar bookkeeping firms now compete with cloud-based services, AI-powered platforms, and hybrid models that blend human expertise with technological efficiency.

The Evolution of Modern Bookkeeping

Traditional bookkeeping involved paper ledgers, physical receipts, and quarterly meetings. Today’s landscape looks dramatically different:

- Cloud-based accessibility allows bookkeepers to work remotely with clients across the country

- Automated transaction categorization reduces manual data entry by up to 80%

- Real-time reporting provides business owners with instant financial insights

- Integration capabilities connect bookkeeping systems with banking, payroll, and inventory management

This evolution means business owners in rural Montana can access the same quality services as those in Manhattan, fundamentally democratizing financial management expertise.

Types of Bookkeeping Service Providers

Understanding the different provider categories helps narrow your search:

Local Bookkeeping Firms 🏢

- Personalized, face-to-face service

- Deep understanding of local tax regulations

- Relationship-based approach

- Limited by geographic constraints

National Bookkeeping Companies 🌎

- Standardized processes and quality control

- Scalable solutions for growing businesses

- Multiple service tiers

- Sometimes less personalized attention

Online Bookkeeping Services 💻

- Lower overhead costs passed to clients

- Technology-first approach

- Subscription-based pricing models

- Requires comfort with virtual communication

Freelance Bookkeepers 👤

- Flexible, customized service

- Often more affordable for small businesses

- Variable quality and reliability

- Limited backup support if unavailable

Top Places to Find Quality Bookkeeping Services

Professional Accounting Associations

The American Institute of Professional Bookkeepers (AIPB) and the National Association of Certified Public Bookkeepers (NACPB) maintain directories of certified professionals. These organizations require members to:

- Pass rigorous certification examinations

- Complete continuing education requirements

- Adhere to professional ethics standards

- Maintain current knowledge of tax laws and regulations

Why this matters: Certification provides assurance of baseline competency and professionalism that self-taught bookkeepers may lack.

Online Marketplaces and Platforms

Several specialized platforms connect businesses with vetted bookkeeping professionals:

Upwork and Freelancer platforms offer access to thousands of bookkeepers worldwide, with detailed profiles, client reviews, and hourly rates. However, quality varies significantly, requiring careful vetting.

Bench, Bookkeeper360, and inDinero represent the new generation of online bookkeeping services, combining proprietary book keeping software with dedicated bookkeeping teams. These platforms typically offer:

- Monthly subscription pricing

- Dedicated bookkeeper assignment

- Software access included

- Monthly financial statement preparation

Local Business Networks and Referrals

The Chamber of Commerce, business networking groups like BNI (Business Network International), and industry associations remain powerful resources for finding trusted bookkeeping services. Personal referrals from fellow business owners provide:

- Firsthand experience insights

- Industry-specific recommendations

- Quality assurance through reputation

- Potential for negotiated rates

CPA Firms and Accounting Practices

Many certified public accounting firms offer bookkeeping services alongside tax preparation and financial consulting. This integrated approach provides:

Seamless tax preparation since your bookkeeper and tax preparer share information and understanding of your business.

Strategic financial guidance that goes beyond transaction recording to business advisory services.

Audit support if your business requires financial statement audits or reviews.

For businesses seeking comprehensive financial support, exploring bookkeeping services for small businesses through established accounting firms often provides the best value.

Evaluating Bookkeeping Software Options

Modern book keeping software has become the backbone of quality bookkeeping services. Understanding these platforms helps evaluate service providers who use them.

Leading Bookkeeping Software Platforms

| Software | Best For | Monthly Cost | Key Features |

|---|---|---|---|

| QuickBooks Online | Small to medium businesses | $30-$200 | Industry standard, extensive integrations, mobile app |

| Xero | Growing businesses, international operations | $13-$70 | Beautiful interface, strong inventory features, multi-currency |

| FreshBooks | Service-based businesses, freelancers | $17-$55 | Time tracking, project management, client invoicing |

| Wave | Micro-businesses, startups | Free (paid add-ons) | Completely free core features, integrated payments |

| Zoho Books | Tech-savvy businesses in Zoho ecosystem | $15-$240 | Deep integration with Zoho suite, automation features |

Software Features That Matter

When evaluating bookkeeping services, ask which software they use and ensure it includes:

✅ Bank feed connectivity for automatic transaction imports

✅ Receipt capture through mobile apps or email forwarding

✅ Accounts payable/receivable management

✅ Financial reporting with customizable dashboards

✅ Multi-user access with permission controls

✅ Integration capabilities with your existing business tools

The right software doesn’t just organize data—it transforms information into actionable business intelligence.

Industry-Specific Bookkeeping Services

Generic bookkeeping services work for many businesses, but specialized providers offer significant advantages for certain industries.

E-commerce and Online Retail

E-commerce businesses face unique challenges:

- Multi-channel sales across platforms like Amazon, Shopify, and eBay

- Complex inventory tracking with COGS calculations

- Payment processor reconciliation for Stripe, PayPal, and others

- Sales tax compliance across multiple jurisdictions

Specialized e-commerce bookkeepers understand marketplace fees, shipping costs allocation, and inventory valuation methods critical for accurate profitability analysis.

Real Estate and Property Management

Real estate professionals require bookkeepers who understand:

- Property-level accounting for multiple assets

- Security deposit tracking and compliance

- 1031 exchange documentation

- Rental income and expense categorization

- Capital improvement vs. repair classification

Healthcare and Medical Practices

Medical practices need bookkeepers familiar with:

- Insurance reimbursement tracking

- HIPAA-compliant financial systems

- Medical billing integration

- Provider compensation models

- Regulatory reporting requirements

Construction and Contractors

Construction bookkeeping demands expertise in:

- Job costing and project profitability

- Progress billing and retainage

- Prevailing wage compliance

- Equipment depreciation and asset management

- Subcontractor payment tracking

Finding providers with industry-specific experience often justifies higher fees through better insights and fewer costly mistakes.

Red Flags and Quality Indicators

Not all bookkeeping services deliver equal value. Recognizing warning signs and quality markers protects your business.

Warning Signs to Avoid

🚩 Unwillingness to provide references from current or former clients

🚩 Lack of professional credentials or verifiable qualifications

🚩 Promises of tax savings without understanding your business

🚩 Resistance to using modern software or cloud-based systems

🚩 Poor communication responsiveness during the sales process

🚩 Extremely low pricing that seems too good to be true

🚩 No written service agreement outlining scope and responsibilities

Quality Indicators to Seek

✨ Professional certifications (CPB, CB, or CPA credentials)

✨ Clear pricing structure with detailed service descriptions

✨ Technology proficiency with current bookkeeping platforms

✨ Regular communication schedule with defined touchpoints

✨ Security protocols for protecting financial data

✨ Backup procedures ensuring business continuity

✨ Proactive advisory beyond basic transaction recording

“The best bookkeepers don’t just record what happened—they help you understand what it means and what to do next.” — Michael Thompson, Small Business Finance Consultant

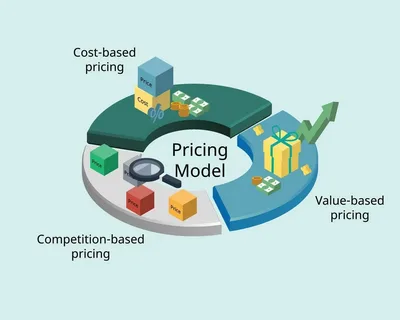

Pricing Models and Cost Considerations

Understanding bookkeeping service pricing helps set realistic budgets and compare value propositions.

Common Pricing Structures

Hourly Rates ($40-$150/hour)

- Traditional billing method

- Flexible for variable needs

- Can be unpredictable for budgeting

- Common for freelancers and local firms

Monthly Flat Fees ($200-$2,500/month)

- Predictable budgeting

- Usually tiered by transaction volume

- May include additional charges for extras

- Popular with online bookkeeping services

Per-Transaction Pricing ($0.50-$2.00/transaction)

- Scales directly with business activity

- Transparent and straightforward

- Can become expensive for high-volume businesses

- Less common in 2025

Package-Based Pricing (Custom)

- Bundled services at set prices

- Often includes software, bookkeeping, and reporting

- May offer better value for comprehensive needs

- Requires careful comparison of inclusions

Factors Affecting Bookkeeping Costs

Several variables influence what you’ll pay for quality bookkeeping services:

Transaction Volume 📊 Businesses processing 200 transactions monthly pay significantly less than those with 2,000 transactions.

Business Complexity 🧩 Multiple entities, international operations, or complex inventory dramatically increase costs.

Industry Requirements 🏭 Specialized industries requiring unique expertise command premium pricing.

Service Level 📈 Basic transaction categorization costs less than comprehensive financial management with advisory services.

Cleanup Needs 🧹 Catching up on months or years of neglected bookkeeping requires additional investment.

Software Costs 💾 Some providers include software in their fees; others require separate subscriptions.

For practical guidance on managing bookkeeping costs effectively, reviewing bookkeeping tips every small business can benefit from provides valuable strategies.

Questions to Ask Potential Bookkeeping Services

The right questions reveal whether a provider matches your needs.

Technical Competency Questions

- What bookkeeping software do you specialize in?

- Ensures compatibility with your systems or willingness to adapt

- How do you handle bank reconciliations?

- Reveals attention to detail and process rigor

- What’s your process for categorizing transactions?

- Shows understanding of chart of accounts and tax implications

- How do you stay current with tax law changes?

- Indicates commitment to ongoing professional development

Service Delivery Questions

- Who will be my primary contact?

- Clarifies whether you’ll work with the owner or junior staff

- What’s your typical response time for questions?

- Sets expectations for communication

- How often will I receive financial reports?

- Ensures alignment with your reporting needs

- What happens if you’re unavailable or on vacation?

- Reveals business continuity planning

Security and Compliance Questions

- How do you protect my financial data?

- Critical for understanding security protocols

- Do you carry professional liability insurance?

- Protects you if errors cause financial harm

- What’s your document retention policy?

- Ensures compliance with IRS and legal requirements

- Are you familiar with my industry’s specific regulations?

- Validates specialized expertise claims

The Role of Technology in Modern Bookkeeping

Technology has transformed bookkeeping from a backward-looking compliance task into a forward-looking strategic function.

Automation and Artificial Intelligence

Modern book keeping software leverages AI to:

- Automatically categorize transactions based on historical patterns

- Detect anomalies that might indicate errors or fraud

- Predict cash flow based on historical trends and upcoming obligations

- Generate insights about spending patterns and profitability drivers

These capabilities don’t replace human bookkeepers—they amplify their effectiveness, allowing professionals to focus on analysis and advisory rather than data entry.

Integration Ecosystems

The best bookkeeping services leverage integrated technology stacks:

Banking Integration connects directly to financial institutions for automatic transaction downloads, eliminating manual entry errors.

Payment Processing Integration links systems like Square, Stripe, or PayPal, ensuring every sale is captured.

Payroll Integration synchronizes employee compensation data, ensuring accurate expense recording and tax compliance.

Inventory Management Integration tracks cost of goods sold in real-time for product-based businesses.

CRM Integration connects customer data with financial information for profitability analysis by client.

This interconnected approach creates a single source of financial truth, accessible from anywhere with internet connectivity.

Mobile Accessibility

Quality bookkeeping services in 2025 provide mobile access for:

- Real-time financial dashboard viewing

- Receipt capture and submission

- Approval workflows for bills and expenses

- Financial report access during meetings or travel

Mobile functionality transforms bookkeeping from an office-bound task to an anywhere, anytime capability.

Regional Considerations for USA Bookkeeping Services

The United States’ size and regulatory diversity create regional considerations when selecting bookkeeping services.

State-Specific Tax Requirements

Different states impose varying obligations:

Sales Tax Complexity 🗺️ States like California have complex district-level sales taxes, while Oregon has none. Bookkeepers familiar with your state’s requirements prevent costly compliance errors.

Income Tax Variations 💰 States with income taxes (like New York) require different bookkeeping approaches than those without (like Texas or Florida).

Employment Taxes 👥 State unemployment insurance, disability insurance, and paid family leave programs vary significantly, requiring specialized knowledge.

Industry-Specific Regulations 🏭 Some states impose unique requirements on specific industries—cannabis businesses face particularly complex compliance challenges.

Urban vs. Rural Considerations

Urban Areas typically offer:

- More provider options and competition

- Higher pricing due to increased overhead

- Greater specialization options

- In-person meeting possibilities

Rural Areas benefit from:

- Online bookkeeping services that overcome geographic limitations

- Potentially lower pricing from local providers

- Necessity of comfort with virtual communication

- Fewer specialized options requiring broader searches

The rise of cloud-based book keeping services has largely eliminated the rural disadvantage, providing equal access to expertise regardless of location.

Building a Successful Bookkeeper Relationship

Finding the right service is just the beginning—maximizing value requires active partnership.

Onboarding Best Practices

Successful bookkeeper relationships start with thorough onboarding:

Organize Historical Records 📚 Provide complete prior-year financial statements, tax returns, and transaction records to establish baseline understanding.

Document Business Processes 📝 Explain how your business operates, revenue streams, expense categories, and any unique aspects affecting finances.

Establish Communication Preferences 📞 Define preferred channels (email, phone, video), frequency, and response time expectations.

Set Clear Expectations 🎯 Discuss deliverables, deadlines, report formats, and decision-making authority.

Grant Appropriate Access 🔐 Provide necessary software logins, bank access (read-only when possible), and documentation systems.

Ongoing Collaboration

Maintain relationship health through:

Regular Review Meetings 📅 Schedule monthly or quarterly sessions to review financial statements, discuss trends, and address questions.

Prompt Information Sharing ⚡ Provide new documents, receipts, and information promptly to prevent backlogs.

Strategic Questions 🤔 Engage your bookkeeper’s expertise beyond transaction recording—ask about tax planning, cash flow optimization, and financial strategy.

Feedback Exchange 💬 Provide constructive feedback about what’s working and what needs adjustment, and be receptive to their suggestions for improving processes.

Annual Relationship Assessment 📊 Evaluate whether the service continues meeting your needs as your business evolves.

For additional insights on optimizing your bookkeeping relationship, the Books on Time blog offers valuable resources and industry updates.

Future Trends in Bookkeeping Services

Understanding where the industry is heading helps select providers positioned for long-term partnership.

Artificial Intelligence and Machine Learning

AI capabilities are rapidly advancing:

- Predictive analytics forecast future cash positions with increasing accuracy

- Anomaly detection identifies unusual transactions requiring investigation

- Natural language processing allows conversational queries about financial data

- Automated decision-making handles routine categorizations with minimal human intervention

The bookkeepers who thrive in 2025 and beyond embrace these tools while providing the human judgment AI cannot replicate.

Advisory Services Expansion

Bookkeeping services increasingly offer strategic advisory:

- Profitability analysis by product, service, or customer

- Scenario modeling for business decisions

- KPI dashboards customized to industry benchmarks

- Strategic planning support informed by financial data

This evolution transforms bookkeepers from historians recording the past into strategic partners shaping the future.

Blockchain and Cryptocurrency

As digital currencies gain mainstream acceptance, bookkeeping services adapt:

- Cryptocurrency transaction recording following evolving accounting standards

- Digital asset valuation and reporting

- Tax compliance for crypto gains and losses

- Blockchain-based audit trails providing immutable transaction records

Businesses involved in cryptocurrency should specifically seek bookkeepers with demonstrated expertise in this emerging area.

Making Your Final Decision

With research complete and options identified, the decision-making process requires systematic evaluation.

Creating Your Comparison Matrix

Develop a structured comparison using these criteria:

Must-Have Requirements ✅

- Industry experience and specialization

- Software platform compatibility

- Certification and credentials

- Security and data protection measures

- Availability and communication standards

Nice-to-Have Features ⭐

- Advisory services beyond basic bookkeeping

- Multi-year experience with businesses your size

- Additional services (payroll, tax preparation, CFO services)

- Technology integrations specific to your industry

- Local presence for occasional in-person meetings

Deal-Breakers ❌

- Lack of professional liability insurance

- Unwillingness to sign confidentiality agreements

- Poor references or online reviews

- Incompatible technology requirements

- Communication style mismatches

Trial Periods and Guarantees

Many quality bookkeeping services offer trial arrangements:

30-60 Day Trial Periods: allow evaluation of service quality, communication effectiveness, and cultural fit before long-term commitment.

Money-Back Guarantees: demonstrate provider confidence in their service quality and reduce your risk.

Flexible Contracts: without long-term lock-in periods provide exit options if the relationship doesn’t meet expectations.

Cleanup Projects: offer opportunities to evaluate a provider’s work quality before committing to ongoing services.

Transition Planning

Once you’ve selected a provider, plan the transition carefully:

Document Current State 📋 Create an inventory of existing financial records, software access, and processes.

Establish Timeline ⏰ Define key milestones for access provisioning, historical data transfer, and first deliverable completion.

Assign Responsibilities 👥 Clarify who handles what during transition—both your team and the new bookkeeper.

Communication Plan 📢 Inform relevant stakeholders (banks, vendors, team members) about the new bookkeeping arrangement.

Success Metrics 📊 Define how you’ll measure whether the new relationship is delivering expected value.

Conclusion: Your Path to Better Financial Management

Finding the best book keeping services in the USA requires understanding your specific needs, researching available options, and systematically evaluating providers against clear criteria. The landscape offers unprecedented choice—from traditional local firms to technology-enabled national services, from generalists to industry specialists, from budget-friendly freelancers to comprehensive CPA firms.

The right bookkeeping service transforms financial management from a dreaded compliance task into a strategic advantage. Quality bookkeepers don’t just record transactions—they provide visibility into business performance, identify improvement opportunities, ensure tax compliance, and free business owners to focus on growth rather than administrative burdens.

Your Next Steps

Immediate Actions 🎯

- Assess your current situation using the cost calculator above to understand budget parameters

- Define your requirements clearly, distinguishing must-haves from nice-to-haves

- Research 3-5 potential providers from different categories (local, online, specialist)

- Request consultations to evaluate communication style and expertise

- Check references thoroughly before making final decisions

Ongoing Optimization 📈

- Schedule quarterly relationship reviews to ensure continued value

- Stay informed about bookkeeping technology advances

- Reassess needs annually as your business evolves

- Maintain organized records to minimize bookkeeper time requirements

- Engage your bookkeeper’s expertise for strategic questions

Long-Term Strategy 🚀

- Build financial literacy to ask better questions and interpret reports effectively

- Consider expanding services (payroll, tax planning, CFO advisory) as needs grow

- Invest in integrated technology that streamlines bookkeeper collaboration

- Use financial insights to drive business decisions and strategic planning

The investment in quality bookkeeping services pays dividends far beyond the monthly fee. Accurate financial records enable better decision-making, reduce tax liability through proper planning, prevent costly compliance penalties, and provide peace of mind that your business finances are in capable hands.

Whether you choose an online platform, local firm, industry specialist, or CPA practice, the key is finding a partner who understands your business, communicates effectively, leverages appropriate technology, and provides proactive guidance beyond basic transaction recording.

Your business deserves financial management that supports growth, ensures compliance, and delivers actionable insights. The best bookkeeping service for your situation is waiting to be discovered—start your search today with the knowledge and tools to make an informed decision that will benefit your business for years to come.