Every business generates financial transactions—purchases, sales, payroll, expenses—but without proper tracking, these numbers become chaos. In 2025, as businesses face increasingly complex financial regulations and competitive pressures, bookkeeping services have evolved from simple number-crunching to strategic financial management tools that can make or break a company’s success.

Whether you’re a startup founder juggling multiple responsibilities, an established business owner seeking to scale, or an accountant advising clients, understanding bookkeeping services isn’t just helpful—it’s essential. The difference between thriving businesses and those that struggle often comes down to one critical factor: knowing exactly where the money is going and making informed decisions based on accurate financial data.

Key Takeaways

- Bookkeeping services systematically record, organize, and manage all financial transactions, providing the foundation for sound business decisions and tax compliance

- Professional bookkeeping saves businesses an average of 15-20 hours per month, allowing owners to focus on revenue-generating activities

- Accurate bookkeeping ensures tax compliance, reduces audit risks, and maximizes eligible deductions, potentially saving thousands in penalties and missed opportunities

- Real-time financial visibility through modern bookkeeping enables strategic planning, cash flow management, and informed growth decisions

- Choosing between in-house, outsourced, or hybrid bookkeeping solutions depends on business size, complexity, budget, and specific industry requirements

Understanding Bookkeeping: The Foundation of Financial Success

What Are Bookkeeping Services?

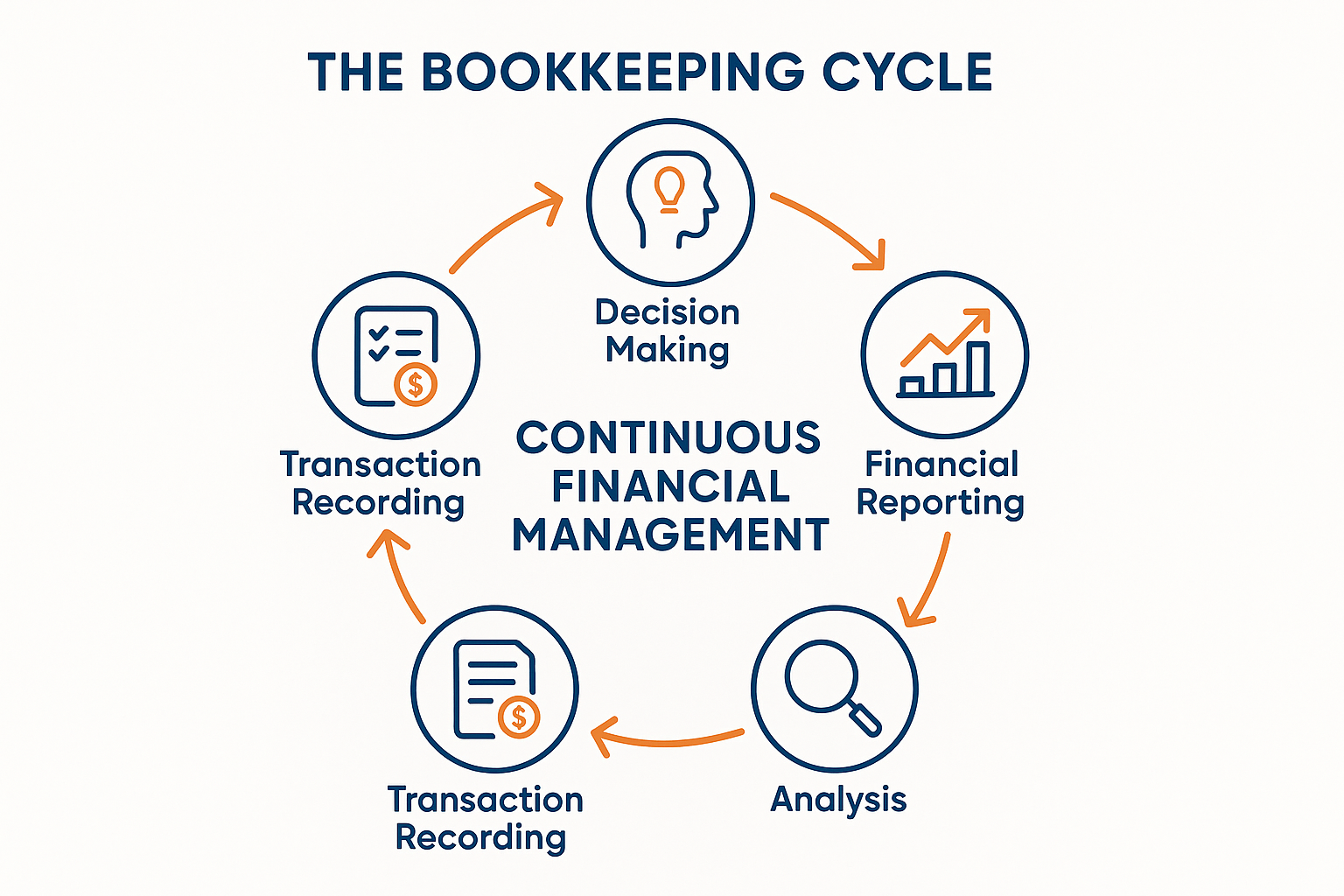

Bookkeeping services encompass the systematic recording, organizing, storing, and retrieving of financial transactions for a business or organization. At its core, bookkeeping creates an accurate, chronological record of every dollar that flows in and out of your business.

Modern bookkeeping services go far beyond simple data entry. They include:

- Transaction recording: Documenting sales, purchases, receipts, and payments

- Account reconciliation: Matching internal records with bank statements

- Accounts payable management: Tracking bills and ensuring timely payments

- Accounts receivable tracking: Monitoring customer invoices and collections

- Payroll processing: Managing employee compensation and tax withholdings

- Financial reporting: Generating profit and loss statements, balance sheets, and cash flow reports

- Tax preparation support: Organizing documentation for accurate tax filing

The distinction between bookkeeping and accounting is important to understand. While bookkeeping focuses on recording and organizing financial data, accounting interprets, analyzes, and summarizes this data to provide strategic insights. Think of bookkeeping as the foundation and accounting as the structure built upon it.

The Evolution of Bookkeeping in 2025

The bookkeeping landscape has transformed dramatically over the past decade. Traditional ledger books and manual entry systems have given way to cloud-based platforms, artificial intelligence, and real-time financial dashboards.

Key technological advances shaping bookkeeping in 2025:

- Cloud-based systems: Access financial data anywhere, anytime, on any device

- AI-powered automation: Automatic transaction categorization and anomaly detection

- Bank integration: Real-time syncing eliminates manual data entry

- Mobile receipt capture: Snap photos of receipts for instant expense tracking

- Enhanced security: Multi-factor authentication and encrypted data storage

- Advanced analytics: Predictive insights and trend analysis

These innovations haven’t eliminated the need for professional bookkeepers—they’ve elevated the role. Today’s bookkeeping professionals combine technical expertise with strategic thinking, using technology to deliver faster, more accurate, and more valuable services.

Why Bookkeeping Services Are Critical for Business Success

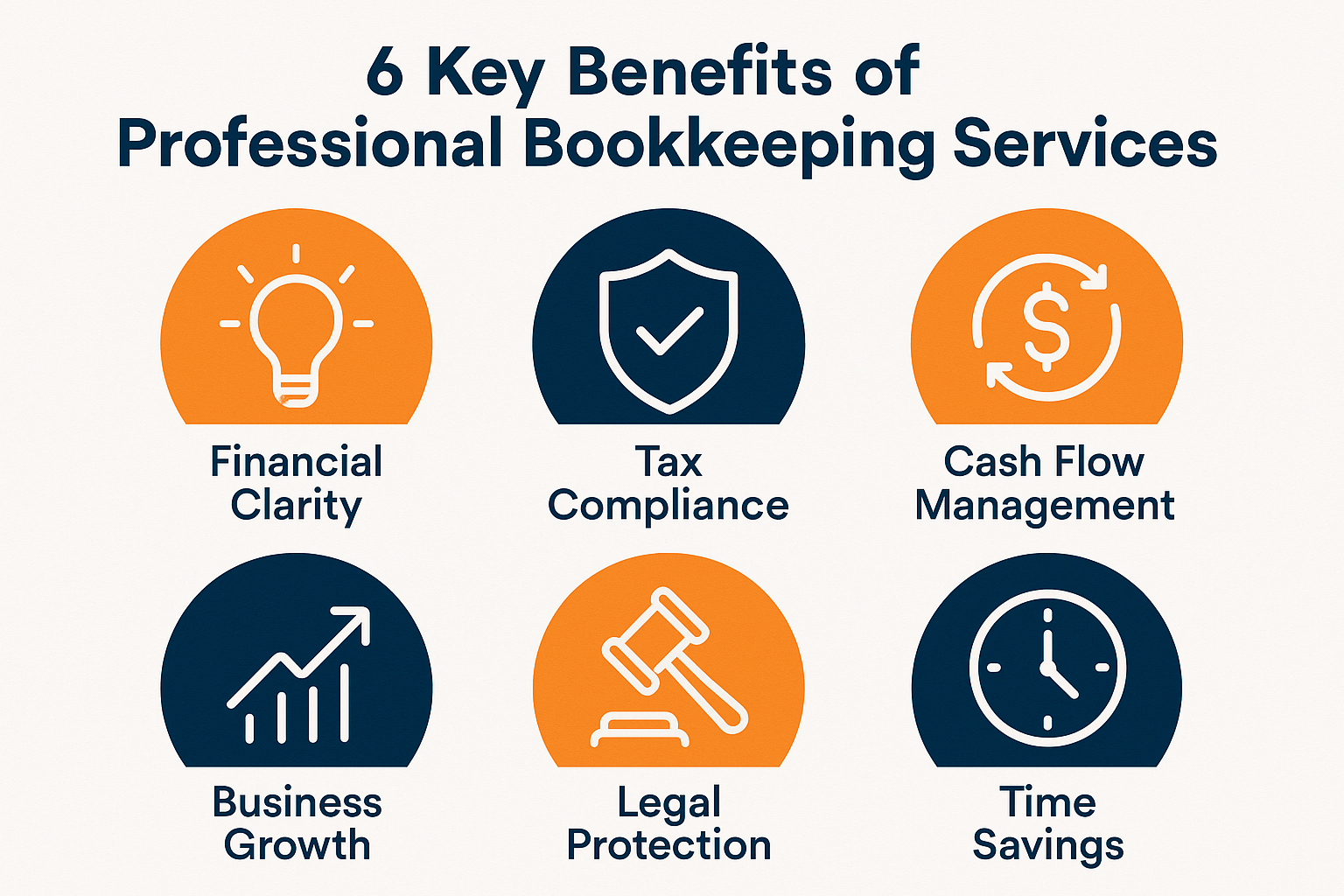

1. Financial Clarity and Decision-Making 💡

Without accurate bookkeeping, business owners operate in the dark. They might feel busy and productive, yet have no clear picture of profitability, cash reserves, or financial health.

Professional bookkeeping provides:

- Real-time visibility into revenue and expenses

- Clear understanding of profit margins by product or service

- Identification of spending patterns and cost-saving opportunities

- Data-driven insights for pricing decisions

- Foundation for accurate financial forecasting

“You can’t manage what you don’t measure. Bookkeeping transforms raw transactions into actionable intelligence that drives better business decisions.” — Financial Management Expert

Consider a retail business owner who discovers through proper bookkeeping that one product line generates 60% of revenue but only 30% of profit due to hidden costs. This insight enables strategic pivots that dramatically improve overall profitability.

2. Tax Compliance and Optimization 📋

Tax obligations represent one of the most compelling reasons businesses invest in professional bookkeeping services. The consequences of poor tax management extend far beyond missed deductions.

Benefits for tax purposes:

| Aspect | With Professional Bookkeeping | Without Proper Bookkeeping |

|---|---|---|

| Deduction capture | Maximized eligible deductions | Missed opportunities costing thousands |

| Audit risk | Minimized through accurate records | Significantly higher due to inconsistencies |

| Filing accuracy | Precise calculations, fewer errors | Common mistakes triggering penalties |

| Preparation time | Streamlined, organized process | Stressful scramble requiring excessive hours |

| Penalty avoidance | Reduced risk of late fees | Higher likelihood of costly penalties |

The IRS and tax authorities worldwide have increased scrutiny on businesses of all sizes. Maintaining detailed, accurate financial records isn’t just good practice—it’s your best defense during an audit and your key to legitimate tax savings.

For detailed guidance on managing your finances effectively, explore our comprehensive bookkeeping tips for small businesses.

3. Cash Flow Management 💵

Cash flow challenges sink more businesses than lack of profitability. A company can be profitable on paper yet fail because it can’t meet immediate financial obligations.

How bookkeeping services support cash flow:

- Track accounts receivable aging to identify slow-paying customers

- Monitor payment terms and optimize collection processes

- Schedule accounts payable to maintain vendor relationships while preserving cash

- Forecast seasonal fluctuations and plan accordingly

- Identify cash flow patterns to prevent shortfalls

- Provide early warning of potential liquidity issues

Effective bookkeeping reveals the timing of cash movements, not just the amounts. This temporal dimension enables proactive management rather than reactive crisis control.

4. Business Growth and Scalability 📈

As businesses grow, financial complexity multiplies exponentially. What worked for a solo entrepreneur becomes completely inadequate for a company with employees, multiple revenue streams, and expanding operations.

Scalability advantages:

- Standardized processes that accommodate increasing transaction volumes

- Historical data for trend analysis and growth planning

- Financial documentation required for loans and investment

- Systems that integrate with inventory, payroll, and CRM platforms

- Benchmarking capabilities to measure progress toward goals

Investors and lenders require thorough financial documentation before committing capital. Professional bookkeeping creates the credibility and transparency that facilitates funding opportunities.

5. Legal Protection and Compliance 🛡️

Beyond tax compliance, businesses face numerous regulatory requirements depending on their industry, location, and structure.

Compliance areas supported by bookkeeping:

- Employment law documentation (payroll records, wage compliance)

- Industry-specific regulations (healthcare, finance, food service)

- Contract fulfillment verification

- Insurance claim substantiation

- Legal dispute documentation

- Partnership and shareholder reporting

Accurate financial records serve as legal protection when disputes arise with customers, vendors, employees, or regulatory agencies. The ability to produce detailed, organized documentation can be the difference between winning and losing costly legal battles.

6. Time Savings and Operational Efficiency ⏰

Time is the most precious resource for business owners and financial professionals. Hours spent on bookkeeping are hours not spent on customer service, product development, marketing, or strategic planning.

Time investment comparison:

- DIY bookkeeping: 10-20+ hours per month for small businesses

- Professional bookkeeping services: 1-3 hours per month for oversight and review

- Net time saved: 15-20 hours monthly to focus on core business activities

The opportunity cost of managing bookkeeping internally often exceeds the cost of professional services. A business owner billing at $150 per hour who spends 15 hours monthly on bookkeeping effectively pays $2,250 for a service that might cost $500-800 professionally.

Types of Bookkeeping Services Available

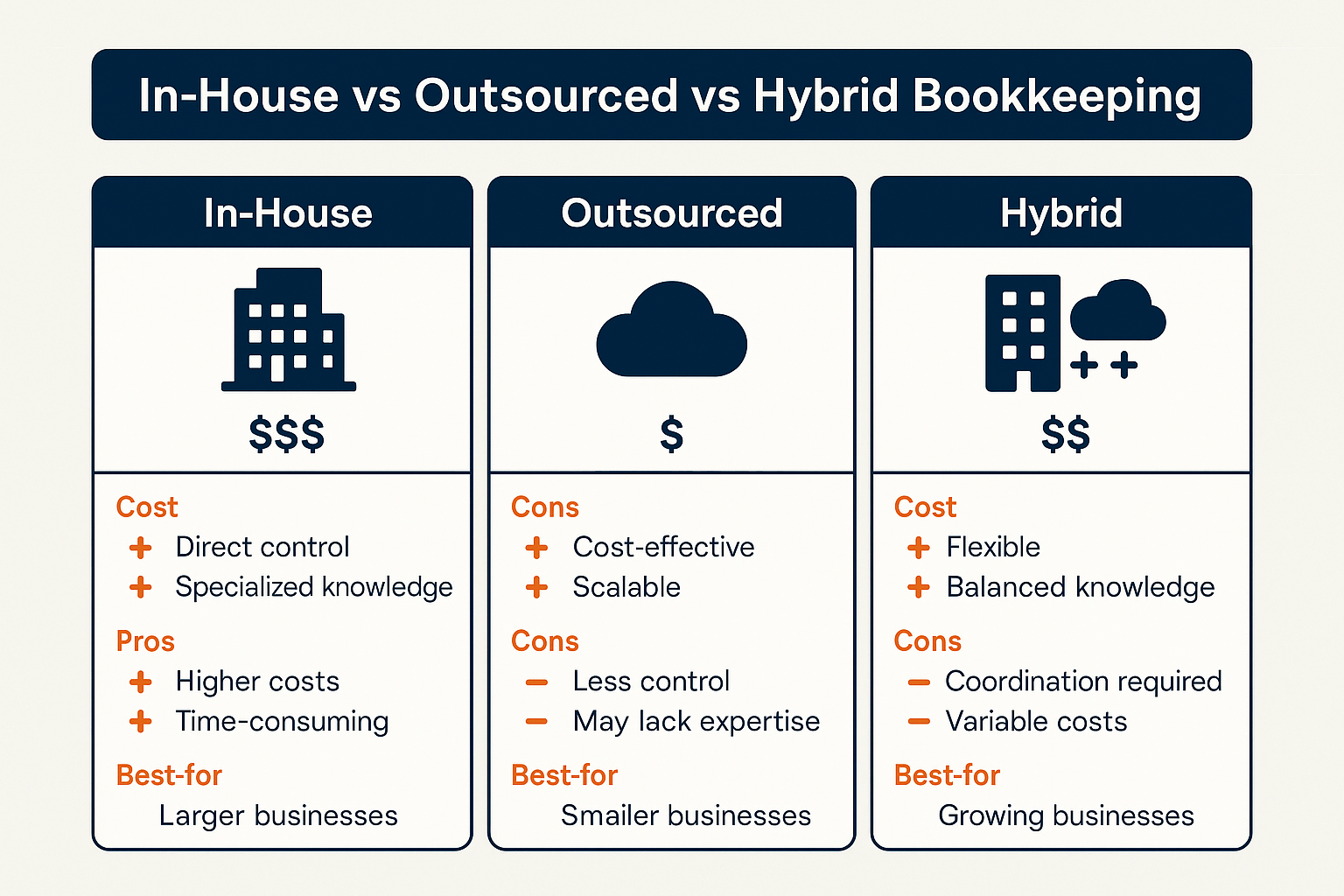

In-House Bookkeeping

In-house bookkeeping involves hiring dedicated staff members to handle financial record-keeping within your organization.

Advantages:

- Immediate availability for questions and urgent needs

- Deep familiarity with your specific business operations

- Direct oversight and control

- Integration with other internal departments

- Potential for expanded responsibilities as business grows

Disadvantages:

- Higher total cost (salary, benefits, training, equipment)

- Dependence on individual employee (vacation, illness, turnover)

- Limited expertise compared to specialized firms

- Potential for errors without external review

- Ongoing training requirements for software and regulation changes

Best for: Mid-sized to large businesses with complex, high-volume transactions requiring daily bookkeeping attention.

Outsourced Bookkeeping Services

Outsourced bookkeeping leverages external professionals or firms to manage your financial records remotely.

Advantages:

- Cost-effective compared to full-time employees

- Access to experienced professionals and specialized expertise

- Scalable services that adjust to business needs

- No concerns about employee turnover or absence

- Latest software and best practices included

- Objective, external perspective on finances

Disadvantages:

- Less immediate availability for spontaneous questions

- Requires trust in external party with sensitive data

- Potential communication delays

- Less intimate knowledge of day-to-day operations

Best for: Small to medium businesses seeking professional expertise without full-time employee costs. Learn more about bookkeeping services for small businesses.

Hybrid Bookkeeping Models

Many businesses adopt hybrid approaches combining internal and external resources.

Common hybrid arrangements:

- Part-time in-house bookkeeper for daily tasks + external CPA for monthly review

- Internal bookkeeper for transaction entry + outsourced payroll processing

- Seasonal scaling (internal during normal periods, external support during peak seasons)

- Technology-assisted DIY with professional quarterly reviews

Best for: Growing businesses transitioning between stages or those with fluctuating bookkeeping demands.

Specialized Industry Bookkeeping

Certain industries require specialized bookkeeping knowledge due to unique regulations, revenue recognition rules, or operational complexities.

Industries with specialized needs:

- Healthcare: HIPAA compliance, insurance billing, medical coding

- Construction: Job costing, progress billing, retention tracking

- Restaurants: Inventory management, tip reporting, high-volume transactions

- E-commerce: Multi-channel sales, inventory across platforms, sales tax nexus

- Real estate: Property-level accounting, tenant tracking, capital improvements

- Professional services: Time tracking, project-based accounting, retainer management

Selecting bookkeeping services with industry-specific experience ensures compliance with sector regulations and maximizes relevant tax advantages.

Key Components of Comprehensive Bookkeeping Services

Daily Transaction Recording

The foundation of bookkeeping involves capturing every financial transaction as it occurs.

Daily activities include:

- Recording sales and revenue from all sources

- Logging expenses and purchases

- Documenting cash receipts and disbursements

- Entering credit card transactions

- Recording bank transfers and fees

- Capturing petty cash expenditures

Modern bookkeeping software automates much of this through bank feeds and receipt scanning, but professional oversight ensures proper categorization and completeness.

Account Reconciliation

Reconciliation matches internal records against external statements to verify accuracy and identify discrepancies.

Critical reconciliation tasks:

- Bank reconciliation: Monthly verification that bank statements match internal records

- Credit card reconciliation: Ensuring all charges are properly recorded

- Merchant account reconciliation: Confirming payment processor deposits match sales

- Inventory reconciliation: Physical counts matching recorded inventory levels

- Accounts receivable reconciliation: Customer account balances verification

Regular reconciliation catches errors, prevents fraud, and ensures financial statements reflect reality.

Accounts Payable Management

Effective accounts payable management balances timely vendor payments with optimal cash flow.

Key processes:

- Organizing and tracking incoming bills

- Verifying invoice accuracy against purchase orders

- Scheduling payments to optimize cash flow and capture discounts

- Maintaining vendor relationships through reliable payment

- Tracking expense categories for budgeting and tax purposes

- Managing 1099 contractor payments and reporting

Strategic accounts payable management can improve vendor terms and free up working capital.

Accounts Receivable Tracking

Accounts receivable represents money owed to your business—an asset only valuable if collected.

Essential AR functions:

- Creating and sending customer invoices promptly

- Tracking payment due dates and aging

- Following up on overdue accounts systematically

- Recording payments and applying to correct invoices

- Managing customer credit terms and limits

- Analyzing collection trends and customer payment patterns

Poor accounts receivable management creates cash flow problems and increases bad debt losses.

Payroll Processing

Payroll represents one of the most complex and regulated bookkeeping functions.

Payroll components:

- Calculating gross wages, overtime, and bonuses

- Computing tax withholdings (federal, state, local)

- Processing benefit deductions (health insurance, retirement)

- Issuing paychecks or direct deposits

- Filing payroll tax returns (quarterly and annual)

- Maintaining detailed payroll records

- Generating W-2s and 1099s annually

Payroll errors create employee dissatisfaction and trigger costly penalties. Many businesses outsource this function even when handling other bookkeeping internally.

Financial Reporting

Financial reports transform raw transaction data into meaningful business intelligence.

Standard reports include:

Profit & Loss Statement (Income Statement)

- Shows revenue, expenses, and net profit over a specific period

- Reveals profitability trends and expense patterns

- Enables comparison across time periods

Balance Sheet

- Snapshot of assets, liabilities, and equity at a specific point

- Indicates financial health and net worth

- Essential for loan applications and investor presentations

Cash Flow Statement

- Tracks actual cash movement in and out of business

- Distinguishes between profit and cash availability

- Critical for managing liquidity

Accounts Receivable Aging Report

- Shows outstanding customer invoices by age category

- Identifies collection problems early

- Guides follow-up prioritization

Expense Reports

- Categorizes spending for analysis

- Compares actual expenses to budgets

- Highlights areas for cost reduction

Regular financial reporting enables proactive management rather than reactive crisis response.

Choosing the Right Bookkeeping Services for Your Business

Assessing Your Business Needs

Before selecting bookkeeping services, conduct an honest assessment of your requirements.

Key considerations:

Transaction Volume

- How many transactions occur monthly?

- Are volumes consistent or seasonal?

- Do you anticipate growth?

Complexity Level

- Single or multiple revenue streams?

- Inventory management required?

- Multi-state or international operations?

- Industry-specific requirements?

Current Pain Points

- What bookkeeping challenges do you face?

- Where do errors typically occur?

- What keeps you awake at night financially?

Time Availability

- How many hours monthly can you dedicate to bookkeeping?

- What’s your opportunity cost per hour?

- Do you enjoy financial management or dread it?

Budget Constraints

- What can you realistically invest in bookkeeping?

- What’s the cost of poor bookkeeping (penalties, missed opportunities)?

- How does outsourcing compare to hiring internally?

Evaluating Service Providers

When considering bookkeeping service providers, thorough vetting prevents costly mistakes.

Essential evaluation criteria:

✅ Qualifications and Experience

- Professional certifications (Certified Bookkeeper, QuickBooks ProAdvisor)

- Years in business

- Industry-specific experience

- Client testimonials and references

✅ Technology and Tools

- Software platforms used

- Cloud accessibility

- Integration capabilities

- Data security measures

✅ Service Scope

- Specific services included

- Response time commitments

- Availability for questions

- Scalability as business grows

✅ Communication Style

- Responsiveness during evaluation

- Clarity in explaining processes

- Proactive communication approach

- Reporting frequency and format

✅ Pricing Structure

- Transparent, detailed pricing

- What’s included vs. additional charges

- Contract terms and flexibility

- Value relative to alternatives

✅ Security and Confidentiality

- Data protection protocols

- Insurance coverage (E&O, cyber liability)

- Confidentiality agreements

- Disaster recovery plans

Questions to Ask Potential Bookkeeping Services

During initial consultations, ask:

- What industries do you specialize in, and do you have experience with businesses like mine?

- Which accounting software do you use, and can you work with my existing system?

- What specific services are included in your standard package?

- How do you handle data security and client confidentiality?

- What is your typical response time for questions or urgent needs?

- How will we communicate, and how often will I receive financial reports?

- What happens if I’m not satisfied with the service?

- Can you provide references from similar clients?

- Are you available during tax season, or do you have capacity constraints?

- How do you stay current with changing tax laws and regulations?

The quality of responses reveals professionalism, expertise, and cultural fit.

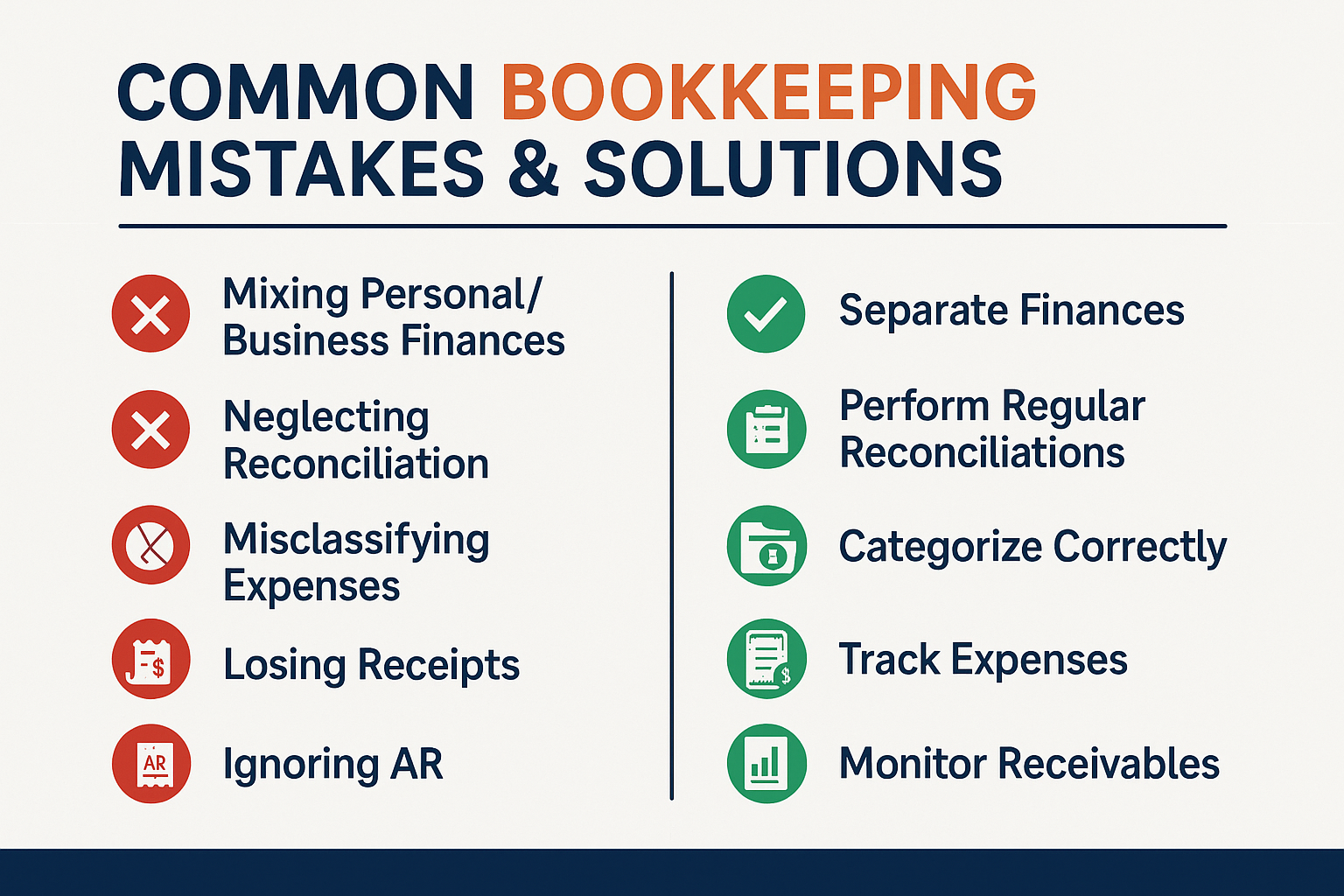

Common Bookkeeping Mistakes and How Professional Services Prevent Them

Mixing Personal and Business Finances

The mistake: Using the same accounts for business and personal transactions creates confusion, complicates tax preparation, and jeopardizes legal protections.

How professionals prevent it: Establishing separate accounts from day one and maintaining strict boundaries through proper categorization and reconciliation.

Neglecting Regular Reconciliation

The mistake: Failing to reconcile accounts monthly allows errors to compound, makes fraud detection difficult, and creates unreliable financial data.

How professionals prevent it: Systematic monthly reconciliation processes catch discrepancies early and ensure data accuracy.

Misclassifying Expenses

The mistake: Incorrect expense categorization leads to inaccurate financial reports, missed tax deductions, and potential audit triggers.

How professionals prevent it: Deep knowledge of tax codes and chart of accounts ensures proper classification from the start.

Losing Receipt Documentation

The mistake: Missing receipts mean lost deductions and vulnerability during audits, potentially costing thousands in disallowed expenses.

How professionals prevent it: Implementing digital receipt capture systems and organized filing processes preserve documentation.

Ignoring Accounts Receivable

The mistake: Failing to follow up on overdue invoices creates cash flow problems and increases bad debt.

How professionals prevent it: Systematic AR tracking and collection processes ensure timely payment and identify problem accounts early.

DIY Payroll Errors

The mistake: Incorrect tax calculations, missed deadlines, and improper documentation trigger penalties and employee issues.

How professionals prevent it: Expertise in payroll regulations and systematic processing eliminate common errors.

Inconsistent Recording

The mistake: Sporadic bookkeeping creates gaps in financial data, making analysis impossible and tax preparation nightmarish.

How professionals prevent it: Scheduled, consistent processes ensure complete, timely recording regardless of business demands.

The ROI of Professional Bookkeeping Services

Quantifiable Benefits

Direct cost savings:

- Tax penalty avoidance: $500-$5,000+ annually

- Maximized deductions: $2,000-$10,000+ in additional tax savings

- Late fee prevention: $300-$1,500+ annually

- Time savings value: $1,800-$3,600+ monthly (15 hours × $120/hour)

- Reduced accounting fees: $500-$2,000+ annually through organized records

Revenue protection:

- Improved collections reducing bad debt by 2-5%

- Early identification of unprofitable products/services

- Better pricing decisions based on accurate cost data

- Cash flow optimization preventing emergency borrowing costs

Intangible Benefits

Beyond direct financial returns, professional bookkeeping delivers valuable intangibles:

- Peace of mind knowing finances are accurate and compliant

- Strategic focus redirecting energy to revenue-generating activities

- Confidence in business decisions backed by reliable data

- Scalability through systems that grow with your business

- Professionalism enhancing credibility with lenders, investors, and partners

- Legal protection through comprehensive documentation

Break-Even Analysis

For a typical small business:

Monthly bookkeeping service cost: $500-$800

Monthly value delivered:

- Time savings (15 hours × $120): $1,800

- Tax optimization: $200

- Error prevention: $100

- Better cash flow management: $300 Total monthly value: $2,400+

ROI: 200-380%

Even conservative estimates show professional bookkeeping services pay for themselves multiple times over.

Integrating Bookkeeping with Overall Business Strategy

Bookkeeping as Strategic Asset

Forward-thinking businesses view bookkeeping not as a compliance burden but as a strategic asset providing competitive advantage.

Strategic applications:

Pricing Optimization Accurate cost data enables profitable pricing strategies rather than guesswork that leaves money on the table or prices you out of the market.

Resource Allocation Understanding which products, services, locations, or customer segments generate the best returns guides intelligent resource investment.

Growth Planning Historical financial trends and current metrics inform realistic growth targets and reveal capacity for expansion.

Risk Management Financial monitoring identifies warning signs early—declining margins, increasing debt, cash flow deterioration—enabling corrective action before crisis.

Performance Measurement Key performance indicators (KPIs) derived from bookkeeping data track progress toward strategic goals and hold teams accountable.

Collaboration Between Bookkeepers and Accountants

While bookkeeping and accounting are distinct functions, maximum value comes from seamless collaboration.

Optimal division of responsibilities:

| Function | Bookkeeper | Accountant |

|---|---|---|

| Transaction recording | ✓ Primary responsibility | Reviews for accuracy |

| Reconciliation | ✓ Monthly execution | Quarterly verification |

| Financial reporting | ✓ Generates standard reports | Analyzes and interprets |

| Tax preparation | Organizes documentation | ✓ Prepares and files returns |

| Strategic planning | Provides data | ✓ Develops recommendations |

| Audit support | Produces records | ✓ Represents and explains |

| System setup | Implements | ✓ Designs chart of accounts |

This partnership ensures accurate data collection feeding sophisticated analysis and strategic guidance.

Technology Integration

Modern bookkeeping exists within an ecosystem of business software.

Critical integrations:

- Banking: Automatic transaction import

- Point of sale: Real-time sales recording

- E-commerce platforms: Multi-channel revenue tracking

- Payroll services: Seamless wage and tax recording

- Inventory management: Cost of goods sold accuracy

- Time tracking: Project profitability analysis

- CRM systems: Customer profitability insights

Professional bookkeeping services navigate these integrations, ensuring data flows smoothly across systems without manual duplication or errors.

Future Trends in Bookkeeping Services

Artificial Intelligence and Automation

AI is transforming bookkeeping from data entry to data intelligence.

Emerging AI applications:

- Smart categorization: Machine learning accurately classifies transactions based on patterns

- Anomaly detection: Automatic flagging of unusual transactions for review

- Predictive analytics: Forecasting cash flow and identifying trends before they fully emerge

- Natural language queries: Asking questions in plain English rather than running complex reports

- Advanced OCR: Extracting data from receipts and invoices with near-perfect accuracy

Rather than replacing bookkeepers, AI elevates them from data processors to financial advisors focusing on interpretation and strategy.

Real-Time Financial Visibility

The shift from monthly to real-time bookkeeping accelerates decision-making.

Real-time capabilities:

- Instant profit and loss visibility

- Live cash position tracking

- Immediate expense approval workflows

- Up-to-the-minute accounts receivable aging

- Real-time budget vs. actual comparisons

This immediacy enables agile business management, responding to opportunities and challenges as they emerge rather than discovering them weeks later.

Advisory Services Expansion

As automation handles routine tasks, bookkeeping services increasingly incorporate advisory elements.

Expanding service offerings:

- Cash flow forecasting and planning

- Budget development and monitoring

- Profitability analysis by product/service

- Pricing strategy recommendations

- Financial goal setting and tracking

- Growth readiness assessments

The bookkeeper role evolves toward trusted financial advisor, providing proactive guidance beyond historical record-keeping.

Enhanced Security Focus

As cyber threats proliferate, bookkeeping services prioritize security.

Security enhancements:

- Multi-factor authentication as standard

- End-to-end encryption for data transmission

- Regular security audits and penetration testing

- Blockchain for immutable transaction records

- AI-powered fraud detection

- Comprehensive cyber insurance coverage

Protecting financial data becomes as important as managing it accurately.

Taking Action: Implementing or Improving Your Bookkeeping

For Businesses Without Formal Bookkeeping

If you’re currently managing finances informally or sporadically, take these steps:

Immediate actions (this week):

- Open separate business bank accounts and credit cards

- Choose accounting software appropriate for your business size

- Gather all financial documents from the past year

- Create a dedicated email for financial communications

- Research bookkeeping service providers in your area or online

Short-term actions (this month):

- Interview at least three bookkeeping service providers

- Request proposals and compare services and pricing

- Check references for top candidates

- Select a provider and sign agreement

- Schedule onboarding and data migration

Ongoing actions:

- Establish weekly routine for receipt capture and documentation

- Review financial reports monthly

- Schedule quarterly meetings to discuss financial trends

- Maintain open communication with your bookkeeping team

- Continuously educate yourself on financial management

For practical guidance on establishing effective systems, review our bookkeeping tips every small business can benefit from.

For Businesses With Existing Bookkeeping

If you have bookkeeping in place but suspect it’s inadequate, conduct an audit:

Assessment questions:

- Are financial reports available within one week of month-end?

- Do reports accurately reflect business reality?

- Are all accounts reconciled monthly?

- Is tax preparation smooth or chaotic?

- Do you understand your cash flow patterns?

- Are you confident in financial data when making decisions?

- Does your bookkeeper proactively communicate insights?

If you answered “no” to multiple questions, consider upgrading your bookkeeping services.

Improvement steps:

- Document current pain points and desired improvements

- Discuss concerns with current provider

- If unresolved, research alternative providers

- Ensure smooth transition with overlapping service periods

- Conduct thorough review of first three months with new provider

For Accountants and Financial Professionals

If you’re advising clients on bookkeeping:

Value-added recommendations:

- Assess client bookkeeping quality during initial consultations

- Maintain relationships with trusted bookkeeping services for referrals

- Educate clients on bookkeeping vs. accounting distinctions

- Review client books quarterly to catch issues early

- Recommend technology upgrades that improve data quality

- Provide clear expectations for documentation needed

- Consider offering bookkeeping services if capacity allows

Quality bookkeeping makes your accounting work easier, more accurate, and more valuable to clients.

Conclusion: The Foundation of Financial Success

Bookkeeping services represent far more than compliance requirements or administrative necessities. They form the foundation upon which successful businesses are built—providing the financial clarity, compliance assurance, and strategic insights that separate thriving enterprises from struggling ones.

In 2025’s complex business environment, the question isn’t whether you need professional bookkeeping, but rather which approach best serves your unique situation. Whether you choose in-house staff, outsourced services, or a hybrid model, the investment in accurate, timely, professional bookkeeping delivers returns that compound over time.

The path forward:

For business owners, commit to treating financial management with the seriousness it deserves. Your bookkeeping system should provide confidence, clarity, and control—not confusion, stress, and uncertainty.

For accountants and financial professionals, recognize that quality bookkeeping is your foundation. Advocate for professional bookkeeping services when advising clients, knowing that better inputs create better outputs.

For those currently struggling with financial chaos, know that help is available and transformation is possible. Professional bookkeeping services can organize years of disorder into clear, actionable intelligence remarkably quickly.

The businesses that thrive in coming years will be those that leverage financial data as a strategic asset. That journey begins with a single decision: to invest in professional bookkeeping services that transform numbers into knowledge and knowledge into growth.

Your financial future is too important to leave to chance. Make bookkeeping a priority, and watch as clarity replaces confusion, confidence replaces anxiety, and strategic growth replaces reactive survival.

Ready to transform your financial management? Explore our comprehensive resources at Books on Time to learn more about building the financial foundation your business deserves.