Every year, small business owners face a critical decision that can make or break their financial success: choosing the right bookkeeping partner. In 2025, with over 33.2 million small businesses operating in the United States alone, the demand for reliable, accurate bookkeeping services has never been higher. Yet, selecting from the hundreds of providers claiming to offer “the best” bookkeeping services can feel overwhelming.

The truth is, there’s no single “best” bookkeeping company for everyone. The ideal provider depends on your business size, industry, budget, and specific financial needs. However, certain companies consistently rise to the top across multiple categories, offering exceptional service, cutting-edge technology, and proven track records that set them apart from the competition.

This comprehensive guide examines the leading bookkeeping service providers in 2025, comparing their strengths, pricing, features, and ideal use cases to help you make an informed decision for your business.

Bookkeeping Best Practices for 2025

Regardless of which provider you choose, following these bookkeeping tips maximizes the value of your investment:

Daily Practices

- Record transactions promptly: Don’t let receipts and invoices pile up

- Separate business and personal finances: Maintain distinct bank accounts and credit cards

- Document everything: Keep digital copies of receipts, invoices, and contracts

- Review cash flow: Monitor daily balances to avoid overdrafts or cash crunches

Weekly Practices

- Process accounts payable: Review and pay bills on schedule

- Follow up on receivables: Send reminders for overdue invoices

- Reconcile payment processors: Match Stripe, PayPal, or Square deposits to sales

- Review upcoming obligations: Plan for payroll, tax payments, or loan installments

Monthly Practices

- Complete bank reconciliations: Ensure all accounts match bank statements

- Review financial statements: Analyze P&L, balance sheet, and cash flow reports

- Assess budget performance: Compare actual results to projections

- Plan for quarterly taxes: Set aside estimated tax payments

- Back up financial data: Ensure secure, redundant data storage

Quarterly Practices

- Review financial trends: Identify patterns in revenue, expenses, and profitability

- Update forecasts: Adjust projections based on actual performance

- Evaluate pricing: Ensure products services remain profitable

- Meet with bookkeeper accountant: Discuss performance and planning

Annual Practices

- Prepare for tax filing: Organize documents and records for accountant

- Review business structure: Assess whether entity type remains optimal

- Update financial goals: Set targets for the coming year

- Evaluate bookkeeping service: Ensure provider continues meeting needs

Bookkeeping Services for Specific Business Types

Different business models have unique bookkeeping requirements. Here’s how to match services to your business type:

E commerce Businesses

Key Requirements:

- Multi channel sales reconciliation (Amazon, eBay, Shopify, etc.)

- Inventory tracking and COGS calculations

- Sales tax compliance across multiple jurisdictions

- Payment processor reconciliation

- Return and refund management

Best Providers: Books on Time (for personalized service), Bench (for hands off management), or A2X + Xero (for Amazon e commerce specialists)

Professional Services (Legal, Medical, Consulting)

Key Requirements:

- Trust account management (legal)

- Insurance billing and reconciliation (medical)

- Client billing and accounts receivable

- Regulatory compliance tracking

- Partner distribution calculations

Best Providers: Books on Time (industry specific expertise), specialized industry bookkeepers

Restaurants and Hospitality

Key Requirements:

- High transaction volume management

- Inventory and food cost tracking

- Tip reporting and allocation

- Multiple payment method reconciliation

- Labor cost management

Best Providers: Books on Time (hospitality expertise), Restaurant365, or industry specific solutions

Retail Businesses

Key Requirements:

- Point of sale system integration

- Inventory management

- Sales tax calculation and filing

- Multi location support (if applicable)

- Cash management and reconciliation

Best Providers: Books on Time (for multi location expertise), QuickBooks Live (for QuickBooks POS users)

Service Based Businesses

Key Requirements:

- Time tracking and project based billing

- Client retainer management

- Contractor payment tracking

- Simple expense categorization

- Profitability by client or project

Best Providers: Books on Time, QuickBooks Live, or FreshBooks with bookkeeping support

How to Choose the Best Bookkeeping Service for Your Business

Selecting the right bookkeeping provider requires careful consideration of multiple factors specific to your business situation.

1. Assess Your Business Complexity

Simple businesses (freelancers, solo consultants, small retailers):

- Limited transaction volume (under 100/month)

- Straightforward revenue streams

- Few employees or contractors

- Best fit: Bookkeeping software or basic hybrid services

Moderate complexity (small businesses, growing companies):

- Multiple revenue streams

- Regular payroll requirements

- Inventory management needs

- Best fit: Professional bookkeeping services like Books on Time

High complexity (established businesses, multi location operations):

- Multiple entities or locations

- International transactions

- Complex inventory or manufacturing

- Best fit: Full service professional firms with specialized expertise

2. Determine Your Involvement Level

How hands on do you want to be with your financial records?

- Highly involved: Bookkeeping software with optional support

- Moderately involved: Hybrid solutions with regular check ins

- Minimal involvement: Full service professional bookkeeping

3. Consider Industry-Specific Needs

Certain industries have unique bookkeeping requirements:

- E commerce: Inventory tracking, multi channel sales reconciliation, sales tax compliance

- Construction: Job costing, progress billing, contractor management

- Professional services: Time tracking, project based billing, client trust accounts

- Restaurants: Inventory management, tip reporting, high transaction volumes

- Healthcare: Insurance billing, HIPAA compliance, complex regulatory requirements

Finding the best bookkeeping services often means prioritizing industry expertise.

4. Evaluate Technology and Integration Requirements

Modern businesses rely on various software tools. Your bookkeeping solution should integrate seamlessly with:

- Payment processors (Stripe, Square, PayPal)

- E commerce platforms (Shopify, WooCommerce, Amazon)

- CRM systems (Salesforce, HubSpot)

- Project management tools (Asana, Monday.com)

- Payroll providers (Gusto, ADP)

- Banking platforms

5. Budget Considerations

Bookkeeping costs vary significantly based on service level and business complexity:

DIY Software: $0-$70 month

- Lowest upfront cost

- Highest time investment

- Risk of errors without expertise

Hybrid Services: $200-$500/month

- Moderate cost

- Professional oversight

- Some time investment required

Full Service Professional: $300-$2,000+ month

- Higher investment

- Minimal time requirement

- Expert accuracy and guidance

- Strategic financial insights

Remember: The cheapest option isn’t always the most cost effective. Bookkeeping errors can cost thousands in penalties, missed deductions, and poor business decisions.

Key Features to Look for in Bookkeeping Services

When evaluating providers, prioritize these essential features:

Essential Features

- Bank Reconciliation: Regular matching of bank statements to recorded transactions

- Financial Reporting: Monthly profit & loss statements, balance sheets, and cash flow reports

- Accounts Payable Receivable: Managing bills and invoices efficiently

- Tax Preparation Support: Organized records and reports for tax filing

- Data Security: Encrypted storage, secure access controls, and regular backups

Advanced Features

- Financial Analysis: Trend identification, KPI tracking, and performance insights

- Budgeting and Forecasting: Future planning based on historical data

- Multi Entity Management: Handling multiple businesses or locations

- Custom Reporting: Tailored reports for specific business needs

- Advisory Services: Strategic financial guidance beyond basic bookkeeping

Technology Features

- Cloud Access: Secure, anywhere access to financial data

- Mobile Apps: On-the go financial management

- Automation: Automatic transaction imports and categorization

- Integration Capabilities: Connecting with existing business tools

- Real Time Updates: Current financial information, not delayed reporting

Key Takeaways

- No universal “best” exists: The ideal bookkeeping service depends on your business size, industry, budget, and specific needs

- Three main categories: Professional bookkeeping firms, bookkeeping software platforms, and hybrid solutions each serve different business requirements

- Books on Time leads for personalized service: Offering dedicated bookkeepers, industry expertise, and comprehensive financial management for small to mid sized businesses

- Software solutions excel for DIY businesses: Platforms like QuickBooks and Xero provide cost effective options for hands on business owners

- Consider scalability: Choose a provider that can grow with your business and adapt to changing financial complexities

Red Flags to Avoid When Choosing a Bookkeeping Service

Not all bookkeeping providers are created equal. Watch out for these warning signs:

Service Quality Concerns

- Lack of credentials: No certified bookkeepers or accountants on staff

- Poor communication: Slow response times or difficulty reaching your bookkeeper

- No industry experience: Generic services without specialized knowledge

- Unclear pricing: Hidden fees or vague cost structures

- No references: Unable or unwilling to provide client testimonials

Technology and Security Issues

- Outdated software: Using obsolete or unsupported platforms

- Weak security measures: No encryption, two factor authentication, or data backup protocols

- Limited access: Restricting your access to your own financial data

- No integrations: Inability to connect with your existing business tools

Business Practice Red Flags

- Guaranteed refunds promises: Unrealistic claims about tax savings

- Pressure tactics: Rushing you into long term contracts

- Offshore only teams: Language barriers or time zone challenges affecting service

- No service agreement: Lack of clear terms, deliverables, and expectations

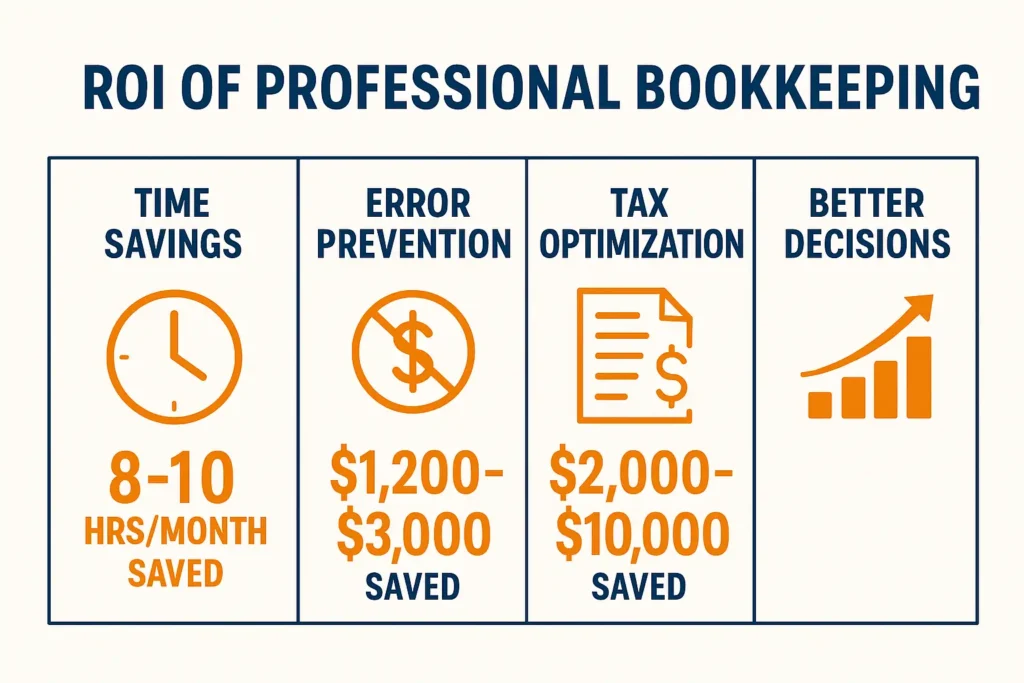

The ROI of Professional Bookkeeping Services

Many small business owners hesitate to invest in professional bookkeeping, viewing it as an expense rather than an investment. However, quality bookkeeping services deliver measurable returns:

Time Savings

Business owners typically spend 8-10 hours monthly on bookkeeping tasks. At an opportunity cost of $50-$150/hour, that’s $400-$1,500 monthly in lost productivity that could be spent on revenue generating activities.

Error Prevention

According to IRS data, bookkeeping errors cost small businesses an average of $1,200-$3,000 annually in penalties, interest, and missed deductions. Professional bookkeepers minimize these costly mistakes.

Tax Optimization

Experienced bookkeepers identify deductions and credits that untrained business owners often miss, potentially saving $2,000-$10,000+ annually in tax liability.

Better Business Decisions

Access to accurate, timely financial information enables smarter decisions about:

- Pricing strategies

- Expense management

- Hiring and expansion timing

- Product or service profitability

- Cash flow optimization

Improved Cash Flow

Professional accounts receivable management can reduce collection time by 15-30%, significantly improving cash flow and reducing the need for expensive short term financing.

Top Bookkeeping Service Providers for 2025

1-800Accountant: Best for Tax Integration

1-800Accountant combines bookkeeping with comprehensive tax services, ideal for businesses wanting an all min one financial solution.

Key Features:

- Monthly bookkeeping services

- Quarterly tax planning

- Annual tax preparation included

- Dedicated tax professional

- Multi state tax support

- Payroll services available

Ideal For:

- Businesses wanting bookkeeping and tax services bundled

- Companies with complex tax situations

- Multi state operations

- Businesses seeking year round tax planning

Pricing:

Plans start at $375/month including tax services.

Bench: Best for Hands Off Bookkeeping

Bench provides a fully managed bookkeeping solution where their team handles everything from transaction imports to financial statement generation.

Key Features:

- Proprietary bookkeeping software

- Dedicated bookkeeping team

- Monthly financial statements

- Tax-ready financials

- Mobile app access

- Annual tax filing available as add on

Ideal For:

- Business owners who want completely hands off bookkeeping

- Companies without existing accounting software preferences

- Service based businesses with moderate transaction volumes

Pricing:

Plans start at $299 month and increase based on monthly expenses.

Books on Time: Best Overall for Small Businesses

Books on Time stands out as the premier choice for bookkeeping services for small businesses seeking personalized, professional financial management.

Why Books on Time Excels

Dedicated Bookkeeping Professionals: Unlike software only solutions, Books on Time assigns experienced bookkeepers who understand your business intimately. This personal touch ensures accuracy, consistency, and proactive financial guidance.

Industry Expertise: The company’s bookkeepers specialize in various industries, from e commerce and retail to professional services and manufacturing. This specialization means they understand industry specific challenges, regulations, and best practices.

Comprehensive Service Offering:

- Full cycle bookkeeping and accounting

- Monthly financial statements and reports

- Accounts payable receivable management

- Payroll processing and tax filing support

- Financial analysis and consulting

- QuickBooks setup and optimization

- Year end tax preparation assistance

Technology Integration: Books on Time leverages modern bookkeeping software while providing the human expertise to interpret and act on the data. This hybrid approach combines efficiency with insight.

Scalability: As your business grows, Books on Time adapts its services to match your evolving needs, from basic transaction recording to complex multi entity accounting.

Ideal For:

- Small to mid sized businesses seeking personalized service

- Companies requiring industry specific expertise

- Business owners who want to focus on growth, not bookkeeping

- Organizations needing strategic financial guidance

Pricing:

Custom pricing based on business complexity, transaction volume, and service requirements. Generally ranges from $300-$2,000+ monthly.

Pilot: Best for Startups and Tech Companies

Pilot specializes in bookkeeping and tax services for startups, particularly those backed by venture capital.

Key Features:

- Accrual based accounting

- Investor ready financial reports

- Cap table management

- R&D tax credit optimization

- CFO services available

- Startup-specific expertise

Ideal For:

- VC backed startups

- Technology companies

- Businesses planning for rapid growth or fundraising

- Companies needing sophisticated financial reporting

Pricing:

Starting at $799 month for bookkeeping services.

QuickBooks Live: Best for QuickBooks Users

For businesses already using or planning to use QuickBooks, QuickBooks Live offers seamless integration with professional bookkeeping support.

Key Features:

- Direct integration with QuickBooks Online

- Certified bookkeepers available on-demand

- Monthly review of financial records

- Transaction categorization and cleanup

- Month end closing assistance

Ideal For:

- Existing QuickBooks users

- Businesses wanting occasional expert guidance

- Companies with straightforward bookkeeping needs

Pricing:

Starting at $200 month for basic services, scaling up based on business size and complexity.

Xero: Best Bookkeeping Software for Growing Businesses

While primarily bookkeeping software, Xero offers an excellent platform with optional certified advisor support through its partner network.

Key Features:

- Unlimited users at all plan levels

- Robust invoicing and inventory management

- Over 1,000 third party integrations

- Multi currency support

- Project tracking capabilities

- Certified advisor network for professional support

Ideal For:

- Growing businesses needing scalable software

- Companies with international operations

- Businesses requiring extensive integrations

- Teams needing multi user access

Pricing:

Software plans from $13-$70 month; professional bookkeeping services through partners vary.

Transitioning to a New Bookkeeping Service

Once you’ve selected a provider, proper transition planning ensures smooth implementation:

Preparation Steps

- Gather historical records: 12-24 months of financial statements, bank statements, and tax returns

- Document current processes: List recurring transactions, bill payment schedules, and reporting needs

- Identify integration requirements: Compile list of software tools requiring connection

- Set clear expectations: Define deliverables, reporting frequency, and communication preferences

- Establish timelines: Plan transition during slower business periods when possible

Implementation Process

Week 1-2: Setup and Onboarding

- Account creation and access setup

- Software installation or training

- Chart of accounts review and customization

- Integration connections established

Week 3-4: Historical Data Review

- Previous period reconciliation

- Opening balance verification

- Historical transaction cleanup

- Baseline financial statement preparation

Month 2: Full Service Commencement

- Regular bookkeeping cycle begins

- First monthly financial statements

- Process refinement based on initial experience

- Additional integration or automation implementation

Month 3+: Optimization

- Workflow efficiency improvements

- Expanded reporting or analysis

- Strategic planning discussions

- Long term relationship development

Common Transition Challenges and Solutions

Challenge: Incomplete or disorganized historical records

Solution: Focus on current period accuracy; work backward as time permits

Challenge: Learning new software or processes

Solution: Schedule dedicated training time; utilize provider support resources

Challenge: Communication gaps with new bookkeeper

Solution: Establish regular check in schedule; use project management tools for transparency

Challenge: Integration technical issues

Solution: Involve IT support early; test integrations thoroughly before full implementation

Understanding Bookkeeping Services in 2025

Before diving into specific providers, it’s essential to understand what bookkeeping services actually entail and why they’re crucial for business success.

What Are Bookkeeping Services?

Bookkeeping is the systematic recording, organizing, and managing of financial transactions for a business. Professional bookkeeping services handle:

- Daily transaction recording and categorization

- Accounts payable and receivable management

- Bank and credit card reconciliation

- Financial statement preparation

- Payroll processing

- Tax preparation support

- Cash flow monitoring

- Expense tracking and reporting

Understanding the purpose of bookkeeping services helps businesses recognize their value beyond simple number crunching they provide the financial clarity needed for strategic decision making.

Types of Bookkeeping Service Providers

The bookkeeping industry has evolved significantly, now offering three primary service models:

- Professional Bookkeeping Firms

- Dedicated human bookkeepers

- Personalized service and consultation

- Industry specific expertise

- Comprehensive financial management

- Dedicated human bookkeepers

- Bookkeeping Software Platforms

- DIY solutions with automated features

- Lower cost, higher user involvement

- Cloud based accessibility

- Integration with business tools

- DIY solutions with automated features

- Hybrid Solutions

- Combination of software and human support

- Scalable service levels

- Technology enhanced efficiency

- Professional oversight when needed

- Combination of software and human support

Conclusion: Finding Your Ideal Bookkeeping Partner

The question “Which company provides the best bookkeeping services?” doesn’t have a single answer but it does have your answer. The ideal provider aligns with your business size, industry, budget, and growth trajectory while delivering the service level that matches your involvement preferences.

For most small businesses seeking comprehensive, personalized bookkeeping with expert guidance, Books on Time offers the optimal combination of professional expertise, industry knowledge, and strategic partnership. Their dedicated bookkeepers provide the accuracy, insights, and support that growing businesses need to make informed financial decisions.

However, businesses with simpler needs might thrive with software solutions like QuickBooks or Xero, while startups requiring sophisticated financial reporting might prefer specialized services like Pilot. The key is honest assessment of your needs and careful evaluation of how each provider addresses them.

Frequently Asked Questions About Bookkeeping Services

Costs vary based on business complexity, transaction volume, and service level. Expect:

DIY software: $0-$70 month

Basic professional services: $200-$500 month

Comprehensive professional services: $500-$2,000+ month

The investment should be evaluated against time savings, error prevention, and strategic value provided.

Bookkeepers record daily transactions, reconcile accounts, and prepare financial statements. Accountants analyze financial data, prepare tax returns, provide strategic advice, and often have higher level certifications (CPA, CMA).

Many businesses need both: bookkeepers for daily operations and accountants for tax planning and strategic guidance.

Yes, though transitions are typically smoother at year end or quarter end. When switching mid year:

Ensure clean handoff of financial records

Verify all reconciliations are current

Document any pending transactions or issues

Plan for potential learning curve period

Quality bookkeeping indicators include:

Timely, accurate financial statements

Clean bank reconciliations with no unexplained discrepancies

Organized, accessible financial records

Proactive communication about issues or opportunities

Tax ready financials requiring minimal accountant cleanup

Generally yes using compatible software streamlines collaboration and ensures real time access to financial data. Many professional services include software access in their pricing or recommend specific platforms optimized for their workflows.