Every small business owner faces a critical crossroads: spend countless hours managing financial records or invest in professional bookkeeping services that could transform their business operations. The difference between these choices often determines whether a business thrives or merely survives. In 2025, with increasingly complex tax regulations and fierce market competition, accurate financial management isn’t optional it’s essential.

Small businesses lose an average of 120 hours annually to bookkeeping tasks, time that could be spent growing revenue, serving customers, and developing new products. Yet many entrepreneurs still hesitate to invest in professional accounting services, unaware of the substantial returns these services deliver.

Key Takeaways

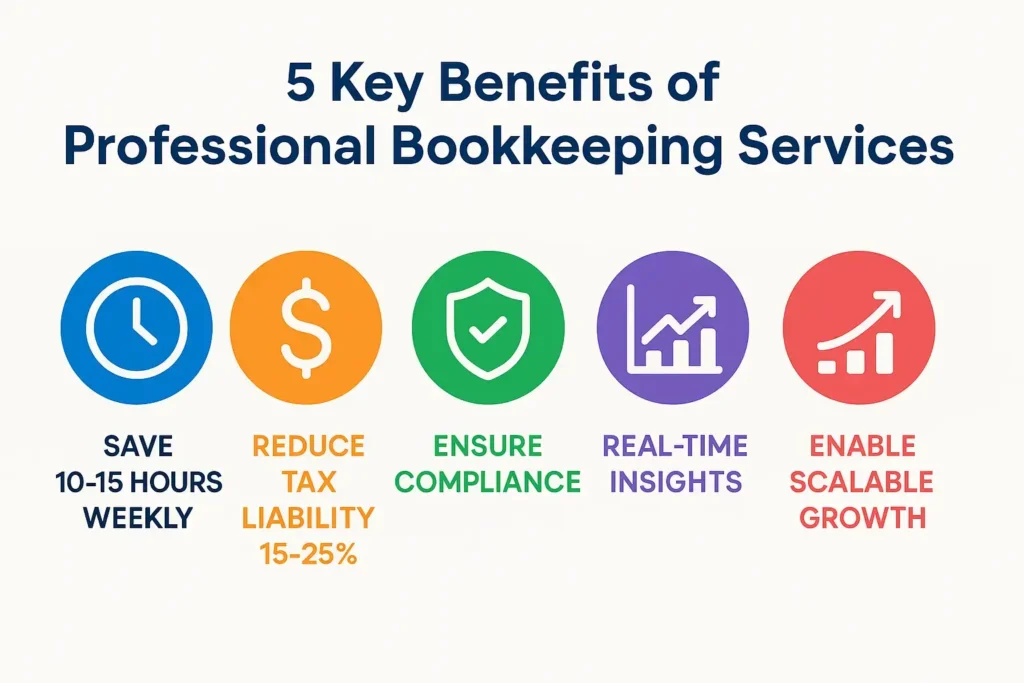

- Professional bookkeeping services save small businesses an average of 10-15 hours weekly, allowing owners to focus on core business activities

- Accurate financial records reduce tax liability by 15-25% through proper deduction tracking and strategic tax planning

- Compliance with tax regulations protects businesses from penalties that can range from hundreds to thousands of dollars

- Real-time financial insights enable data-driven decisions that improve profitability and sustainable growth

- Outsourcing bookkeeping costs 40-60% less than hiring a full-time, in-house bookkeeper with benefits

Understanding Bookkeeping Services for Small Businesses

Bookkeeping forms the foundation of every successful business’s financial infrastructure. At its core, bookkeeping involves systematically recording, organizing, and managing all financial transactions that occur within a business. This includes tracking income, expenses, assets, liabilities, and equity.

For small businesses, bookkeeping services encompass several critical functions:

Core Bookkeeping Functions

Transaction Recording

Every purchase, sale, payment, and receipt must be accurately documented. Professional bookkeepers ensure that no financial activity goes unrecorded, creating a complete audit trail for your business.

Account Reconciliation

Regular reconciliation matches your internal records with bank statements, credit card statements, and other financial documents. This process identifies discrepancies, prevents fraud, and ensures accuracy.

Financial Reporting

Bookkeepers generate essential reports including profit and loss statements, balance sheets, and cash flow statements. These documents provide crucial insights into business performance.

Accounts Payable Management

Tracking bills, managing vendor relationships, and ensuring timely payments maintains good credit standing and vendor relationships.

Accounts Receivable Management

Recording customer invoices, tracking payments, and following up on overdue accounts ensures healthy cash flow.

Understanding what bookkeeping services entail helps business owners make informed decisions about their financial management needs.

The Difference Between Bookkeeping and Accounting Services

While often used interchangeably, bookkeeping and accounting services serve distinct but complementary roles in financial management.

| Aspect | Bookkeeping Services | Accounting Services |

| Primary Focus | Recording daily transactions | Analyzing and interpreting financial data |

| Scope | Tactical, day-to-day operations | Strategic, big-picture planning |

| Key Activities | Data entry, reconciliation, invoicing | Tax planning, financial analysis, advisory |

| Credentials | Certification helpful but not always required | CPA or advanced degree typically required |

| Timing | Ongoing, daily/weekly tasks | Periodic reviews, quarterly/annual planning |

| Output | Organized financial records | Strategic recommendations and insights |

Bookkeeping creates the data foundation, while accounting transforms that data into actionable business intelligence. Small businesses typically need both services, though the intensity and frequency may vary based on business size, complexity, and industry.

Professional accounting services build upon accurate bookkeeping to deliver:

- Tax strategy and preparation that minimizes liability

- Financial forecasting for growth planning

- Business advisory services for strategic decisions

- Audit support when required by lenders or investors

- Compliance guidance for industry-specific regulations

Why Small Businesses Need Professional Bookkeeping Services

The purpose of bookkeeping services extends far beyond simple record-keeping. Here’s why professional services deliver exceptional value:

1. Time Savings and Productivity Gains

Small business owners wear many hats—CEO, salesperson, customer service representative, and often bookkeeper. This fragmentation dilutes focus from revenue-generating activities.

Professional bookkeeping services reclaim 10-15 hours weekly, time that can be redirected toward:

- Developing new products or services

- Building customer relationships

- Implementing marketing strategies

- Improving operational efficiency

2. Accuracy and Error Prevention

Financial errors create cascading problems:

- Tax miscalculations leading to penalties and interest

- Cash flow mismanagement causing missed opportunities

- Inaccurate pricing decisions eroding profit margins

- Compliance violations triggering audits and legal issues

Professional bookkeepers employ systematic processes, double-entry accounting, and regular reconciliation to maintain 99%+ accuracy rates.

3. Financial Visibility and Decision-Making

“You can’t manage what you don’t measure.” This business axiom applies perfectly to financial management.

Professional bookkeeping provides:

- Real-time financial dashboards showing current business health

- Trend analysis identifying growth opportunities and warning signs

- Budget variance reports highlighting areas needing attention

- Profitability analysis by product, service, or customer segment

4. Tax Optimization and Compliance

Tax regulations change frequently, and missing deductions costs small businesses thousands annually. Professional bookkeepers:

- Track all deductible expenses throughout the year

- Maintain documentation required for tax substantiation

- Identify tax-saving opportunities in real-time

- Ensure compliance with federal, state, and local requirements

- Prepare organized records for tax preparation

5. Scalability and Growth Support

As businesses grow, financial complexity increases exponentially. Professional bookkeeping services scale seamlessly, handling:

- Multiple revenue streams

- Inventory management

- Multi-state operations

- Employee payroll and benefits

- Complex vendor relationships

Explore comprehensive bookkeeping services that grow with your business needs.

Types of Bookkeeping Services Available

Small businesses can choose from various service models, each offering distinct advantages:

In-House Bookkeeping

Pros:

- Direct control and immediate access

- Deep company knowledge

- Integration with daily operations

- Real-time communication

Cons:

- Highest cost (salary, benefits, equipment, training)

- Limited expertise breadth

- Vacation and sick day coverage challenges

- Potential for reduced objectivity

Best For: Larger small businesses with complex, daily bookkeeping needs requiring constant attention.

Outsourced Bookkeeping Services

Pros:

- Cost-effective (40-60% less than in-house)

- Access to experienced professionals

- Scalable services matching business needs

- Latest technology and best practices

- Continuity regardless of individual availability

Cons:

- Less immediate access

- Requires clear communication protocols

- May need time to understand business nuances

Best For: Most small businesses seeking professional expertise without full-time employee costs.

Hybrid Approach

Some businesses employ a part-time bookkeeper for daily tasks while outsourcing complex functions like payroll, tax preparation, or financial analysis. This model balances control with expertise.

Cloud-Based Bookkeeping Services

Modern online bookkeeping services leverage technology to deliver:

- Real-time access to financial data from anywhere

- Automated transaction categorization reducing manual entry

- Bank feed integration for seamless reconciliation

- Collaborative platforms enabling easy communication

- Secure cloud storage protecting financial data

Essential Bookkeeping Services Every Small Business Needs

While specific needs vary by industry and business model, certain bookkeeping functions prove universally essential:

1. General Ledger Maintenance

The general ledger serves as the master financial record, containing all accounts and transactions. Professional maintenance ensures:

- Proper account structure aligned with business needs

- Accurate categorization of all transactions

- Regular reconciliation preventing errors

- Audit-ready documentation

2. Accounts Payable Processing

Effective accounts payable management:

- Tracks all vendor bills and payment terms

- Schedules payments to optimize cash flow

- Captures early payment discounts

- Maintains positive vendor relationships

- Prevents late fees and penalties

3. Accounts Receivable Management

Strong receivables management accelerates cash collection through:

- Timely, accurate invoice generation

- Payment tracking and aging reports

- Professional collection follow-up

- Customer account reconciliation

- Bad debt identification and management

4. Bank Reconciliation

Monthly bank reconciliation:

- Verifies accuracy of recorded transactions

- Identifies unauthorized charges or fraud

- Catches bank errors

- Ensures complete transaction recording

- Provides accurate cash position

5. Financial Statement Preparation

Regular financial statements deliver critical business insights:

Profit & Loss Statement (Income Statement)

Shows revenue, expenses, and profitability over a specific period.

Balance Sheet

Presents assets, liabilities, and equity at a specific point in time.

Cash Flow Statement

Tracks cash movement through operating, investing, and financing activities.

Statement of Owner’s Equity

Documents changes in business ownership value.

6. Payroll Processing

Payroll services handle:

- Employee wage calculations

- Tax withholding and remittance

- Benefits administration

- Compliance with labor laws

- Year-end tax form preparation (W-2s, 1099s)

7. Sales Tax Management

For businesses collecting sales tax:

- Accurate tax calculation and collection

- Proper documentation and reporting

- Timely remittance to tax authorities

- Multi-jurisdiction compliance

- Nexus determination and management

How to Choose the Right Bookkeeping Service Provider

Selecting the right bookkeeping partner significantly impacts business success. Consider these critical factors:

1. Industry Experience and Expertise

Different industries have unique accounting requirements:

- Retail: Inventory management, point-of-sale integration

- Professional Services: Project-based accounting, billable hours tracking

- E-commerce: Multi-channel sales reconciliation, marketplace fees

- Construction: Job costing, progress billing, retention tracking

- Healthcare: Insurance billing, HIPAA compliance

Choose providers with demonstrated expertise in your industry.

2. Technology and Software Proficiency

Modern bookkeeping relies on technology. Ensure providers are proficient in:

- Cloud accounting platforms (QuickBooks Online, Xero, FreshBooks)

- Payment processing integration (Stripe, PayPal, Square)

- Bank feed connections for automated transaction import

- Receipt capture technology (Dext, Hubdoc)

- Reporting and analytics tools

3. Service Scope and Customization

Evaluate whether providers offer:

- À la carte services matching specific needs

- Scalable packages accommodating growth

- Specialized services (CFO advisory, controller services)

- Tax preparation or partnerships with tax professionals

- Industry-specific expertise

4. Communication and Responsiveness

Effective bookkeeping requires clear communication:

- What are typical response times?

- How do they handle urgent questions?

- What communication channels do they offer?

- Do they provide a dedicated point of contact?

- How frequently do they provide updates?

5. Security and Data Protection

Financial data requires robust security:

- Encryption protocols for data transmission and storage

- Access controls limiting who can view sensitive information

- Backup procedures preventing data loss

- Compliance certifications (SOC 2, GDPR if applicable)

- Insurance coverage protecting against breaches

6. Pricing Structure and Transparency

Understand the complete cost picture:

- Fixed monthly fees vs. hourly rates

- What’s included in base pricing

- Additional charges for extra services

- Setup or onboarding fees

- Contract terms and cancellation policies

When searching for the best bookkeeping services in the USA, prioritize providers offering transparent pricing and clear service agreements.

7. References and Track Record

Validate provider credibility through:

- Client testimonials and case studies

- Online reviews and ratings

- Professional certifications and credentials

- Years in business and client retention rates

- Industry awards or recognition

The Cost of Bookkeeping Services in 2025

Understanding bookkeeping costs helps budget appropriately and evaluate ROI. Pricing varies based on several factors:

Pricing Models

Hourly Rates

- Entry-level bookkeepers: $20-$35/hour

- Experienced bookkeepers: $35-$60/hour

- Specialized or certified bookkeepers: $60-$100/hour

Monthly Packages

- Basic services (small businesses, simple transactions): $200-$500/month

- Standard services (moderate complexity, regular reporting): $500-$1,000/month

- Comprehensive services (complex operations, multiple entities): $1,000-$2,500/month

- Full-service accounting (bookkeeping + CFO advisory): $2,500-$5,000+/month

Cost Factors

Transaction Volume

More transactions require more time and higher fees. Businesses with hundreds of monthly transactions pay more than those with dozens.

Business Complexity

Multiple revenue streams, inventory, job costing, and multi-state operations increase complexity and cost.

Industry Requirements

Specialized industries with unique compliance needs (construction, healthcare, nonprofits) typically command premium pricing.

Service Scope

Full-service packages including payroll, tax preparation, and financial analysis cost more than basic transaction recording.

Software and Technology

Some providers include software subscriptions in their fees; others charge separately.

ROI Considerations

While bookkeeping represents a business expense, it delivers measurable returns:

- Time savings: 10-15 hours weekly = $500-$1,500 monthly at $50/hour opportunity cost

- Tax savings: 15-25% reduction in tax liability through proper planning

- Error prevention: Avoiding penalties, interest, and costly mistakes

- Cash flow improvement: Better collection and payment management

- Growth enablement: Data-driven decisions accelerating revenue growth

For most small businesses, professional bookkeeping pays for itself multiple times over.

Implementing Bookkeeping Services: A Step-by-Step Guide

Successfully integrating bookkeeping services requires thoughtful planning and execution:

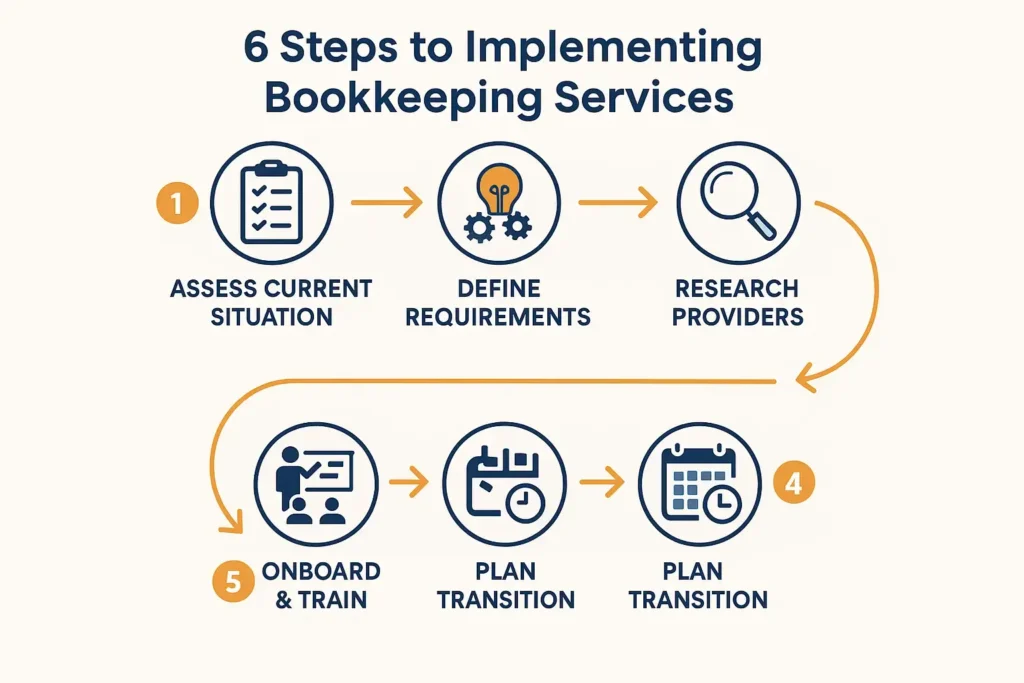

Step 1: Assess Your Current Situation

Evaluate existing processes:

- How are financial records currently maintained?

- What software or systems are in use?

- Where are the biggest pain points?

- What compliance requirements exist?

- What reports are needed and how frequently?

Identify specific needs:

- Transaction volume and complexity

- Industry-specific requirements

- Growth plans and scalability needs

- Budget constraints

- Internal resource availability

Step 2: Define Service Requirements

Create a clear scope of work including:

- Daily, weekly, and monthly tasks

- Reporting requirements and deadlines

- Communication preferences and frequency

- Software and technology needs

- Performance metrics and expectations

Step 3: Research and Select a Provider

Use the selection criteria outlined earlier to:

- Identify 3-5 potential providers

- Request proposals and pricing

- Check references and credentials

- Conduct interviews or consultations

- Compare offerings and make a selection

Review the best bookkeeping services to identify top-rated providers.

Step 4: Plan the Transition

Organize historical records:

- Gather previous financial statements

- Compile bank and credit card statements

- Collect vendor and customer lists

- Document current processes and passwords

Set up systems and access:

- Choose and configure accounting software

- Establish bank feed connections

- Grant appropriate access permissions

- Set up communication channels

Define workflows:

- Document approval processes

- Establish document submission procedures

- Create communication protocols

- Set regular meeting schedules

Step 5: Onboard and Train

Initial setup period:

- Review chart of accounts and make adjustments

- Import historical data if needed

- Establish baseline reports

- Clarify questions and confirm understanding

Knowledge transfer:

- Explain business-specific nuances

- Share industry context and relationships

- Identify seasonal patterns or unusual transactions

- Establish expectations and preferences

Step 6: Monitor and Optimize

Regular performance review:

- Are reports delivered on time and accurately?

- Is communication meeting expectations?

- Are questions answered promptly?

- Is the service delivering expected value?

Continuous improvement:

- Identify process inefficiencies

- Adjust service scope as needs change

- Leverage new features or capabilities

- Provide feedback for better service

Common Bookkeeping Challenges and Solutions

Even with professional services, small businesses encounter bookkeeping obstacles. Here’s how to address them:

Challenge 1: Disorganized Records and Receipts

Problem: Missing receipts, lost invoices, and incomplete documentation create gaps in financial records and complicate tax preparation.

Solutions:

- Implement digital receipt capture using mobile apps

- Establish mandatory documentation procedures

- Use cloud storage for centralized record-keeping

- Schedule weekly document submission deadlines

- Automate expense reporting where possible

Challenge 2: Inconsistent Processes

Problem: Irregular bookkeeping creates inaccurate reports, delayed insights, and year-end scrambles.

Solutions:

- Establish fixed schedules for bookkeeping tasks

- Create checklists and standard operating procedures

- Use calendar reminders for recurring activities

- Automate repetitive tasks through software

- Hold regular financial review meetings

Challenge 3: Cash Flow Mismanagement

Problem: Poor cash flow visibility leads to late payments, missed opportunities, and financial stress.

Solutions:

- Implement weekly cash flow forecasting

- Accelerate receivables through prompt invoicing

- Negotiate favorable payment terms with vendors

- Maintain cash reserves for seasonal fluctuations

- Use cash flow dashboards for real-time visibility

Challenge 4: Mixing Personal and Business Finances

Problem: Commingled accounts complicate bookkeeping, reduce tax deductions, and create legal liability issues.

Solutions:

- Open separate business bank accounts and credit cards

- Pay yourself a regular salary or owner’s draw

- Reimburse business expenses rather than direct payment

- Document any personal use of business assets

- Maintain clear separation for legal protection

Challenge 5: Lack of Financial Understanding

Problem: Business owners who don’t understand financial reports can’t make informed decisions.

Solutions:

- Request simplified, visual financial dashboards

- Schedule regular review sessions with your bookkeeper

- Learn basic financial statement interpretation

- Ask questions until concepts are clear

- Focus on key metrics relevant to your business

Implementing these bookkeeping tips for small businesses significantly improves financial management effectiveness.

Technology and Tools for Modern Bookkeeping

Technology has revolutionized bookkeeping, making professional-grade financial management accessible to small businesses:

Cloud Accounting Software

QuickBooks Online

The market leader offers comprehensive features, extensive integrations, and scalable pricing tiers suitable for most small businesses.

Xero

Known for excellent bank reconciliation, unlimited users, and beautiful reporting, Xero serves growing businesses well.

FreshBooks

Ideal for service-based businesses, FreshBooks excels at time tracking, project management, and client invoicing.

Wave

Free accounting software funded by payment processing and payroll add-ons, perfect for very small businesses and startups.

Automation Tools

Bank Feed Integration

Automatic transaction import eliminates manual data entry and accelerates reconciliation.

Receipt Capture Apps

Tools like Dext (formerly Receipt Bank) and Hubdoc photograph receipts, extract data, and attach documentation automatically.

Expense Management

Platforms like Expensify streamline employee expense reporting and reimbursement.

Invoicing Automation

Recurring invoice generation, automatic payment reminders, and online payment acceptance improve cash flow.

Integration Capabilities

Modern bookkeeping platforms integrate with:

- Payment processors (Stripe, PayPal, Square)

- E-commerce platforms (Shopify, WooCommerce, Amazon)

- Point-of-sale systems (Square, Clover, Lightspeed)

- Payroll services (Gusto, ADP, Paychex)

- Time tracking tools (TSheets, Harvest, Toggl)

- Inventory management (TradeGecko, Cin7, Fishbowl)

These integrations eliminate duplicate data entry and ensure accuracy across systems.

Industry-Specific Bookkeeping Considerations

Different industries face unique bookkeeping challenges requiring specialized knowledge:

Retail and E-commerce

Key considerations:

- Multi-channel sales reconciliation (online, in-store, marketplaces)

- Inventory valuation and cost of goods sold tracking

- Sales tax nexus across multiple states

- Returns and refund management

- Seasonal fluctuation planning

Professional Services

Key considerations:

- Time and billing management

- Project-based accounting and profitability

- Work-in-progress tracking

- Retainer management

- Client trust accounting (for lawyers, accountants)

Construction and Contractors

Key considerations:

- Job costing and project tracking

- Progress billing and retention

- Subcontractor management and 1099 reporting

- Equipment depreciation

- Prevailing wage compliance

Restaurants and Hospitality

Key considerations:

- High transaction volume management

- Inventory and food cost tracking

- Tip reporting and allocation

- Multiple payment type reconciliation

- Labor cost management

Healthcare Practices

Key considerations:

- Insurance billing and reimbursement tracking

- Patient account management

- HIPAA compliance for financial data

- Medical supply inventory

- Provider compensation arrangements

Understanding what bookkeeping services include for your specific industry ensures you receive appropriate support.

The Future of Bookkeeping Services

The bookkeeping profession continues evolving rapidly, driven by technology and changing business needs:

Artificial Intelligence and Machine Learning

AI-powered bookkeeping tools increasingly:

- Automatically categorize transactions with high accuracy

- Detect anomalies and potential errors

- Predict cash flow based on historical patterns

- Provide intelligent recommendations

- Learn business-specific patterns over time

Real-Time Financial Management

Cloud technology enables:

- Instant access to current financial position

- Real-time collaboration between businesses and bookkeepers

- Immediate alerts for important events or thresholds

- Continuous reconciliation rather than month-end processes

- Dynamic forecasting updated with each transaction

Advisory Services Expansion

As automation handles routine tasks, bookkeepers increasingly provide:

- Strategic financial planning and analysis

- KPI development and monitoring

- Scenario modeling and forecasting

- Business performance optimization

- Growth strategy support

Increased Specialization

Bookkeepers increasingly specialize in:

- Specific industries or business models

- Particular accounting software platforms

- Niche services (cryptocurrency, international operations)

- Business stage focus (startups, scaling businesses, mature companies)

Enhanced Security and Compliance

Growing cyber threats and regulatory requirements drive:

- Advanced encryption and security protocols

- Multi-factor authentication standards

- Enhanced audit trails and documentation

- Automated compliance monitoring

- Blockchain-based verification systems

Making the Decision: When to Hire Bookkeeping Services

Certain business situations particularly benefit from professional bookkeeping:

Startup Phase

Why it matters: Establishing proper financial foundations prevents costly mistakes and positions businesses for growth and funding.

What to prioritize: Basic transaction recording, expense categorization, financial statement preparation, and tax compliance.

Rapid Growth Period

Why it matters: Scaling businesses face increasing transaction volume and complexity that overwhelm informal systems.

What to prioritize: Scalable processes, cash flow management, financial forecasting, and systems integration.

Tax Season Stress

Why it matters: Scrambling to organize records for tax preparation wastes time, increases costs, and risks errors.

What to prioritize: Year-round transaction recording, receipt organization, deduction tracking, and tax-ready reporting.

Funding or Sale Preparation

Why it matters: Investors and buyers require clean, accurate financial records demonstrating business performance.

What to prioritize: Historical cleanup, professional financial statements, audit preparation, and due diligence support.

Owner Burnout

Why it matters: Entrepreneurs spending excessive time on bookkeeping can’t focus on business growth and strategic priorities.

What to prioritize: Complete outsourcing of routine bookkeeping tasks, freeing time for high-value activities.

Explore comprehensive bookkeeping services for small businesses to find solutions matching your specific situation.

Maximizing Value from Your Bookkeeping Services

To optimize the return on your bookkeeping investment:

1. Provide Complete and Timely Information

Best practices:

- Submit documents on schedule (weekly or bi-weekly)

- Provide context for unusual transactions

- Communicate changes in business operations

- Share upcoming plans affecting finances

- Respond promptly to bookkeeper questions

2. Review Reports Regularly

Key actions:

- Schedule monthly financial review meetings

- Compare actual performance to budget

- Identify trends and patterns

- Ask questions about unexpected results

- Use insights to inform decisions

3. Establish Clear Communication

Success factors:

- Define preferred communication channels

- Set expectations for response times

- Schedule regular check-ins

- Provide constructive feedback

- Build a collaborative relationship

4. Leverage Expertise Beyond Numbers

Additional value:

- Request process improvement recommendations

- Ask about industry best practices

- Seek referrals to complementary professionals

- Tap into technology knowledge

- Utilize strategic planning insights

5. Invest in Financial Literacy

Personal development:

- Learn to read financial statements

- Understand key performance indicators

- Grasp basic accounting principles

- Stay informed about tax law changes

- Develop business acumen

Conclusion: Investing in Financial Excellence

Professional bookkeeping and accounting services represent far more than a business expense they’re a strategic investment in sustainable growth, financial health, and peace of mind. In 2025’s competitive business environment, accurate financial management separates thriving businesses from struggling ones.

The benefits extend well beyond organized records:

Time freedom to focus on revenue-generating activities and strategic priorities

Financial clarity enabling confident, data-driven decision-making

Tax optimization maximizing deductions and minimizing liability

Compliance assurance protecting against penalties and legal issues

Scalable systems supporting growth without increasing complexity

Professional credibility when seeking funding, partnerships, or acquisitions

For small business owners juggling countless responsibilities, delegating bookkeeping to qualified professionals isn’t admitting weakness—it’s demonstrating wisdom. The most successful entrepreneurs recognize their limitations and build teams of experts supporting business success.