In today’s rapidly evolving business landscape, traditional bookkeeping and tax preparation are no longer enough to keep companies competitive. Business owners now face complex financial decisions daily from optimizing cash flow and managing growth to navigating economic uncertainty and planning strategic exits. This is where advisory in accounting transforms from a luxury service into a critical business necessity.

Advisory accounting services, particularly CFO advisory services, represent a fundamental shift from reactive number-crunching to proactive financial leadership. These services empower businesses with strategic insights, forward looking analysis, and executive level financial guidance without the cost of hiring a full time Chief Financial Officer.

Understanding Advisory in Accounting: The Foundation

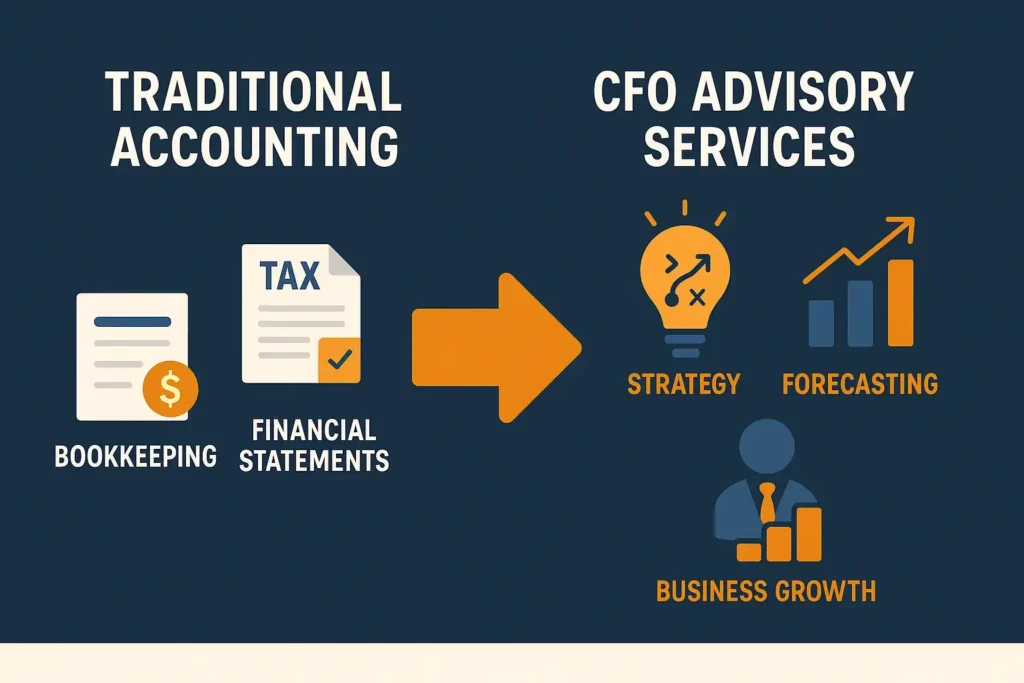

Advisory in accounting refers to consulting and strategic services that accounting professionals provide beyond standard compliance and transactional work. While traditional bookkeeping services focus on recording financial transactions and maintaining accurate records, advisory services use that financial data to provide strategic recommendations and business insights.

Think of it this way: traditional accounting tells you what happened financially, while advisory accounting helps you understand why it happened and what to do next.

The Evolution from Transactional to Strategic Accounting

The accounting profession has undergone a dramatic transformation over the past decade. Several factors have driven this evolution:

Technology and Automation

- Cloud based accounting software has automated many routine bookkeeping tasks

- Real time financial data is now readily accessible

- Accountants can focus on analysis rather than data entry

Increasing Business Complexity

- Global competition requires more sophisticated financial strategies

- Regulatory environments continue to grow more complex

- Business owners need expert guidance to navigate challenges

Growing Demand for Strategic Partnership

- Entrepreneurs want advisors, not just number-crunchers

- Businesses seek proactive insights rather than historical reports

- Companies need strategic financial leadership to scale successfully

This evolution has created space for specialized accounting services that blend financial expertise with business strategy the essence of advisory accounting.

What Are CFO Advisory Services?

Defining the CFO Advisory Role

A CFO advisor (also called a fractional CFO, virtual CFO, or outsourced CFO) provides Chief Financial Officer level expertise on a part time, project based, or retainer basis. These professionals deliver the strategic financial leadership that growing businesses need without requiring the investment of a full time executive salary.

CFO advisory services typically include:

- Strategic financial planning and analysis

- Cash flow management and forecasting

- Financial modeling and scenario planning

- Budgeting and variance analysis

- KPI development and performance monitoring

- Fundraising and investor relations support

- Mergers and acquisitions guidance

- Risk management and internal controls

- Technology selection and implementation

- Team building and finance function optimization

How CFO Advisory Differs from Traditional Accounting

Aspect | Traditional Accounting | CFO Advisory Services |

|---|---|---|

| Focus | Historical data and compliance | Future-oriented strategy and growth |

| Timing | Retrospective (what happened) | Prospective (what will happen) |

| Deliverables | Financial statements, tax returns | Strategic plans, forecasts, recommendations |

| Engagement | Periodic reporting | Ongoing partnership and consultation |

| Value | Accuracy and compliance | Business insights and decision support |

| Scope | Recording and reporting | Analysis, planning, and execution |

| Perspective | Transaction-level detail | Big-picture strategic view |

Understanding these differences helps business owners recognize when they’ve outgrown basic bookkeeping services for small businesses and need more strategic financial guidance.

Core Components of Advisory Accounting Services

1. Financial Planning and Analysis (FP&A)

Financial planning and analysis forms the backbone of CFO advisory services. This component includes:

Strategic Planning

- Long term financial goal setting

- Capital allocation strategies

- Investment analysis and prioritization

- Growth planning and expansion strategies

Budgeting and Forecasting

- Annual budget development

- Rolling forecasts (quarterly or monthly updates)

- Scenario modeling (best case, worst case, most likely)

- Variance analysis and course correction

Performance Management

- Key Performance Indicator (KPI) identification and tracking

- Dashboard creation for real time visibility

- Trend analysis and pattern recognition

- Benchmarking against industry standards

2. Cash Flow Management and Optimization

Cash flow challenges remain one of the top reasons businesses fail. A skilled CFO advisor helps companies:

- Develop accurate 13 week cash flow forecasts

- Identify cash flow bottlenecks and inefficiencies

- Optimize accounts receivable and payable processes

- Establish working capital management strategies

- Create cash reserve policies and emergency funds

- Implement cash flow improvement initiatives

Real World Impact: Many businesses discover they’re profitable on paper but struggle with cash flow timing. Advisory services bridge this gap by creating systems that ensure cash availability when needed.

3. Strategic Business Advisory

Beyond the numbers, CFO advisory services provide strategic counsel on critical business decisions:

Growth Strategies

- Market expansion analysis

- Product line profitability assessment

- Pricing strategy optimization

- Customer acquisition cost analysis

Operational Efficiency

- Process improvement recommendations

- Cost reduction opportunities

- Margin enhancement strategies

- Resource allocation optimization

Risk Management

- Financial risk identification and mitigation

- Scenario planning for economic uncertainty

- Insurance and liability assessment

- Compliance and regulatory guidance

4. Fundraising and Capital Strategy

For businesses seeking growth capital, a CFO advisor provides invaluable support:

- Financial package preparation for investors or lenders

- Valuation analysis and negotiation support

- Capital structure optimization (debt vs. equity)

- Investor pitch deck development

- Due diligence coordination

- Deal structuring and term sheet review

5. Technology and Systems Optimization

Modern businesses require robust financial systems. Advisory services help with:

- Accounting software selection and implementation

- Financial reporting automation

- System integration and data flow optimization

- Dashboard and analytics tool deployment

- Best practices for bookkeeping system setup

Who Needs CFO Advisory Services?

Growing Small to Medium Businesses

Companies experiencing rapid growth often reach an inflection point where basic bookkeeping no longer suffices. Signs you might need CFO advisory services include:

Revenue exceeding $1-2 million annually

Managing multiple revenue streams or product lines

Planning significant expansion or market entry

Experiencing cash flow challenges despite profitability

Seeking outside investment or financing

Lacking clear financial visibility or reporting

Making strategic decisions without data-driven insights

Startups and Entrepreneurs

Early stage companies benefit enormously from CFO advisor expertise:

- Establishing solid financial foundations from the start

- Creating realistic financial projections for investors

- Developing sustainable business models

- Avoiding common financial pitfalls

- Building scalable financial processes

Established Businesses in Transition

Companies undergoing significant changes need strategic financial guidance:

- Ownership transitions or succession planning

- Mergers, acquisitions, or divestitures

- Market disruption or business model pivots

- Turnaround situations requiring financial restructuring

- Preparing for sale or exit events

Companies Not Ready for a Full-Time CFO

The most common scenario: businesses that need executive level financial expertise but cannot justify (or afford) a full-time CFO salary, which typically ranges from $150,000 to $400,000+ annually plus benefits.

CFO advisory services provide access to this expertise at a fraction of the cost often 20-40% of a full time hire with the flexibility to scale engagement up or down as needs change.

The Business Impact of Advisory Accounting Services

Measurable Benefits and ROI

Organizations that engage CFO advisory services typically experience:

Improved Profitability

- Average profit margin improvements of 5-15%

- Better pricing strategies based on accurate cost analysis

- Identification and elimination of unprofitable products or services

- Enhanced gross margin through operational efficiency

Enhanced Cash Flow

- Reduced cash flow gaps and working capital needs

- Faster collections and optimized payment terms

- Better cash forecasting reducing emergency borrowing

- Improved access to favorable financing terms

Accelerated Growth

- Data driven decision making supporting expansion

- Successful fundraising efforts with professional financial packages

- Strategic resource allocation maximizing return on investment

- Confident scaling based on solid financial foundations

Risk Mitigation

- Early identification of financial challenges

- Proactive problem solving before issues become critical

- Improved compliance and reduced regulatory risk

- Better preparedness for economic uncertainty

Strategic Advantages

Beyond measurable metrics, accounting services with an advisory focus provide:

- Competitive Intelligence: Understanding how your financial performance compares to industry benchmarks

- Strategic Clarity: Clear financial roadmaps aligned with business goals

- Stakeholder Confidence: Professional financial reporting that impresses investors, lenders, and partners

- Management Bandwidth: Freeing leadership to focus on core business rather than financial complexities

- Institutional Knowledge: Access to expertise across industries and business situations

How to Choose the Right CFO Advisory Partner

Key Qualifications to Look For

When selecting a CFO advisor or advisory firm, consider:

Professional Credentials

- CPA, CMA, or MBA qualifications

- Relevant industry certifications

- Years of experience in CFO or senior financial roles

- Track record with businesses similar to yours

Industry Expertise

- Understanding of your specific sector

- Familiarity with industry specific challenges and metrics

- Network of industry contacts and resources

- Knowledge of relevant regulations and compliance requirements

Technology Proficiency

- Experience with modern accounting platforms

- Ability to leverage automation and analytics tools

- Understanding of your existing systems

- Forward thinking approach to financial technology

Communication Skills

- Ability to explain complex financial concepts simply

- Regular, proactive communication style

- Presentation skills for board or investor meetings

- Collaborative approach with your team

Questions to Ask Potential Advisors

Before engaging CFO advisory services, ask:

- What industries and company sizes do you typically serve?

- Can you provide references from similar businesses?

- What is your engagement model (hourly, retainer, project based)?

- How do you ensure knowledge transfer to our internal team?

- What systems and tools do you typically work with?

- How quickly can you respond to urgent financial questions?

- What additional resources or team members would support our engagement?

- How do you measure success in advisory engagements?

- What is your approach to building financial processes and systems?

- How do you stay current with accounting standards and best practices?

Engagement Models and Pricing

CFO advisory services typically offer flexible engagement options:

Retainer Based

- Monthly fee for ongoing advisory support

- Defined scope of services and deliverables

- Predictable costs and consistent availability

- Best for: Companies needing regular strategic guidance

Project Based

- Fixed fee for specific initiatives

- Defined timeline and outcomes

- Focused expertise for particular challenges

- Best for: One time needs like fundraising or system implementation

Hourly Consulting

- Pay for time as needed

- Flexible for variable requirements

- No long term commitment

- Best for: Occasional strategic questions or limited scope work

Hybrid Models

- Combination of retainer and project fees

- Base level of support plus special initiatives

- Scalable as business needs evolve

- Best for: Growing companies with changing requirements

Pricing typically ranges from $150-$500+ per hour or $2,000-$15,000+ monthly for retainer arrangements, depending on business complexity, advisor experience, and scope of services.

Integrating Advisory Services with Your Existing Accounting Function

Building a Cohesive Financial Team

CFO advisory services work best when integrated thoughtfully with existing financial resources. Here’s how to create synergy:

Define Clear Roles

- Bookkeeper/Accountant: Transaction recording, accounts payable receivable, reconciliations

- Controller (if applicable): Financial reporting, compliance, internal controls

- CFO Advisor: Strategy, planning, analysis, executive decision support

Establish Communication Protocols

- Regular check ins between all financial team members

- Shared access to financial systems and data

- Clear escalation paths for issues or questions

- Collaborative planning and review sessions

Leverage Technology

- Cloud based systems accessible to all team members

- Shared dashboards and reporting tools

- Integrated workflows minimizing data duplication

- Real time visibility for timely decision-making

Transitioning from Basic Bookkeeping to Advisory

Many businesses start with basic bookkeeping services and gradually add advisory capabilities. This transition typically follows these stages:

Stage 1: Foundation

- Accurate transaction recording

- Monthly financial statement preparation

- Basic compliance and tax preparation

- Clean, organized financial data

Stage 2: Enhanced Reporting

- Customized management reports

- Departmental or product line profitability analysis

- Cash flow statements and projections

- KPI tracking and dashboards

Stage 3: Strategic Advisory

- Forward looking forecasts and budgets

- Scenario modeling and what if analysis

- Strategic planning support

- Executive level consultation

Stage 4: Full CFO Partnership

- Comprehensive financial leadership

- Board level financial reporting

- Fundraising and M&A support

- Enterprise wide financial strategy

Understanding the purpose of bookkeeping services as the foundation for advisory work helps businesses appreciate how these services complement each other.

Common Challenges and How Advisory Services Address Them

Challenge 1: Limited Financial Visibility

The Problem: Many business owners lack clear, timely insight into their financial performance. They receive financial statements weeks or months after the period ends, making it difficult to respond to issues promptly.

The Advisory Solution:

- Implementation of real time financial dashboards

- Weekly or daily key metric reporting

- Automated alerts for concerning trends

- Accessible, understandable financial summaries

Challenge 2: Cash Flow Unpredictability

The Problem: Businesses struggle to predict cash needs, leading to emergency borrowing, missed opportunities, or inability to meet obligations.

The Advisory Solution:

- Rolling 13-week cash flow forecasts

- Scenario planning for different business conditions

- Working capital optimization strategies

- Cash management policies and procedures

Challenge 3: Uninformed Decision Making

The Problem: Strategic decisions are made based on intuition rather than data, leading to suboptimal outcomes and missed opportunities.

The Advisory Solution:

- Financial modeling for major decisions

- Cost benefit analysis frameworks

- Return on investment calculations

- Data driven recommendation reports

Challenge 4: Scaling Challenges

The Problem: Financial systems and processes that worked at smaller scale become bottlenecks during growth, creating chaos and errors.

The Advisory Solution:

- Scalable process design and documentation

- System selection and implementation support

- Team structure recommendations

- Growth ready financial infrastructure

Challenge 5: Fundraising Difficulties

The Problem: Businesses struggle to secure financing due to inadequate financial packages, unrealistic projections, or poor presentation of their financial story.

The Advisory Solution:

- Professional financial package preparation

- Realistic, defensible financial projections

- Investor ready presentations and pitch decks

- Negotiation support and deal structuring

The Future of Advisory in Accounting

Emerging Trends in CFO Advisory Services

The accounting services landscape continues to evolve rapidly. Key trends shaping the future include:

Artificial Intelligence and Automation

- AI powered forecasting and anomaly detection

- Automated report generation and distribution

- Predictive analytics for proactive decision support

- Natural language interfaces for financial queries

Real Time Advisory

- Shift from monthly to continuous advisory support

- Instant access to financial insights

- Proactive alerts and recommendations

- On-demand strategic consultation

Industry Specialization

- Deeper expertise in specific sectors

- Vertical specific benchmarking and best practices

- Specialized regulatory and compliance knowledge

- Industry network access and connections

Integrated Business Advisory

- Blending financial, operational, and strategic consulting

- Holistic business performance optimization

- Cross functional collaboration and insight

- End to end business transformation support

Sustainability and ESG Integration

- Environmental, Social, and Governance (ESG) metrics

- Sustainability reporting and strategy

- Impact measurement and optimization

- Stakeholder value beyond financial returns

Preparing Your Business for Advisory Partnership

To maximize value from CFO advisory services, businesses should:

Establish Clean Financial Data

- Ensure accurate, up to date bookkeeping

- Reconcile all accounts regularly

- Organize historical financial records

- Document key processes and policies

Define Clear Objectives

- Identify specific challenges or goals

- Prioritize areas needing advisory support

- Set measurable success criteria

- Align leadership on expectations

Commit to Collaboration

- Provide timely access to information

- Engage actively in advisory discussions

- Implement recommended strategies

- Maintain open, honest communication

Invest in Technology

- Adopt cloud based accounting platforms

- Implement integrated business systems

- Embrace automation where appropriate

- Provide advisor access to systems

Taking Action: Your Next Steps

Assessing Your Advisory Needs

Use this simple framework to determine if CFO advisory services are right for your business:

Score each statement from 1-5 (1=Strongly Disagree, 5=Strongly Agree):

- We lack clear visibility into our financial performance

- Cash flow challenges limit our growth or operations

- We make important decisions without comprehensive financial analysis

- Our financial systems and processes feel inadequate for our current size

- We’re planning significant growth, fundraising, or transitions

- We don’t have executive level financial expertise in-house

- Our current financial reports don’t provide actionable insights

- We struggle to create accurate forecasts and budgets

- We need help preparing for investors, lenders, or potential buyers

- Our leadership team spends too much time on financial issues

Scoring:

- 40-50: Strong candidate for comprehensive CFO advisory services

- 30-39: Would benefit significantly from targeted advisory support

- 20-29: Consider specific project based advisory for key challenges

- Below 20: May be well served by enhanced bookkeeping and reporting

Finding the Right Advisory Partner

When you’re ready to engage CFO advisory services:

- Research Options: Look for advisors with relevant industry experience and strong credentials

- Check References: Speak with current and former clients about their experience

- Start Small: Consider a pilot project before committing to ongoing engagement

- Evaluate Fit: Ensure cultural alignment and communication compatibility

- Clarify Expectations: Document scope, deliverables, and success metrics clearly

For businesses seeking to strengthen their financial foundation first, exploring comprehensive bookkeeping services can prepare you for advisory partnership.

Building Your Financial Future

The journey from basic accounting to strategic CFO advisory is transformational. It represents a shift from viewing financial management as a necessary burden to embracing it as a strategic advantage.

Immediate Actions You Can Take:

Audit Your Current Financial Capabilities: Identify gaps between current state and where you need to be

Research Advisory Options: Investigate providers specializing in your industry and business size

Prepare Your Financial House: Ensure clean, accurate data and organized systems

Define Your Goals: Clarify what success looks like and how advisory services can help

Start the Conversation: Reach out to potential advisors for exploratory discussions

Remember, the best time to engage advisory services is before you’re in crisis mode. Proactive strategic financial guidance prevents problems rather than just solving them.

Conclusion

Advisory in accounting represents the evolution of financial services from historical record-keeping to forward-looking strategic partnership. CFO advisory services empower businesses with executive level financial expertise, providing the insights, analysis, and guidance needed to navigate complexity, capitalize on opportunities, and achieve sustainable growth.

Whether you’re a startup laying financial foundations, a growing business scaling operations, or an established company navigating transition, CFO advisor expertise can be transformational. These services bridge the gap between where your business is today and where you want it to be tomorrow turning financial data into strategic advantage.

The question isn’t whether your business can benefit from advisory services, but rather when to begin this partnership. As the business landscape grows increasingly complex and competitive, strategic financial guidance transitions from luxury to necessity.