Running a small business often feels like juggling flaming torches while riding a unicycle is exciting, but one wrong move could spell disaster. While many entrepreneurs excel at their craft, they frequently struggle with the complex financial decisions that determine whether their business thrives or merely survives. This is where fractional CFO services can transform a company’s trajectory, providing expert financial leadership without the six figure salary of a full time executive.

In 2025, the business landscape has become increasingly complex, with inflation concerns, evolving tax regulations, and fierce competition making strategic financial planning more critical than ever. Small businesses face the same financial challenges as large corporations but rarely have the resources to hire a full time Chief Financial Officer. Enter the fractional CFO, a seasoned financial expert who provides high level CFO advisory services on a part time or project basis, delivering enterprise level financial strategy at a fraction of the cost.

What Is a Fractional CFO?

A fractional CFO (also called a part-time CFO or outsourced CFO) is an experienced financial executive who works with multiple companies simultaneously, providing each client with strategic financial guidance on a flexible, part-time basis. Unlike traditional bookkeeping services, which focus on recording transactions and maintaining financial records, a CFO advisor operates at the strategic level analyzing data, forecasting trends, and guiding critical business decisions.

Think of it this way: if your bookkeeper is the mechanic who keeps your engine running smoothly, your fractional CFO is the navigator who ensures you’re heading in the right direction, optimizing your route, and planning for obstacles ahead.

How Fractional CFOs Differ from Traditional Accounting Services

Many business owners confuse accounting services with CFO level financial strategy. While both are essential, they serve distinctly different purposes:

| Traditional Accounting Services | CFO Advisory Services |

|---|---|

| Record historical transactions | Create forward-looking financial models |

| Prepare tax returns and compliance documents | Develop tax optimization strategies |

| Generate financial statements | Interpret financial data for strategic decisions |

| Manage accounts payable/receivable | Optimize cash flow and working capital |

| Focus on accuracy and compliance | Focus on growth and profitability |

| Tactical, day-to-day operations | Strategic, long-term planning |

Understanding what bookkeeping services entail helps clarify why many businesses need both foundational accounting and strategic CFO guidance.

The Evolution of Financial Leadership in Small Business

The traditional model required companies to choose between hiring no financial leadership or committing to a full time CFO earning $150,000-$400,000 annually. This left small and mid sized businesses in a vulnerable position too large to operate without strategic financial guidance, yet too small to justify the expense.

The fractional CFO model emerged as the perfect solution, democratizing access to expert financial leadership. In 2025, this approach has become mainstream, with thousands of businesses leveraging CFO advisory expertise to navigate economic uncertainty and capitalize on growth opportunities.

Eight Compelling Reasons Small Businesses Need a Fractional CFO

Strategic Cash Flow Management

Cash flow problems kill more businesses than lack of profitability. A company can show profit on paper while simultaneously running out of money to pay employees or suppliers a phenomenon that confuses many entrepreneurs.

A fractional CFO brings sophisticated cash flow forecasting tools and expertise that transform how businesses manage their most precious resource: liquidity. They create 13 week cash flow projections, identify seasonal patterns, and implement strategies to smooth out the peaks and valleys that plague many small businesses.

Real world impact: A fractional CFO might identify that your payment terms (Net 60 to customers, Net 30 to suppliers) create an unnecessary cash crunch. By negotiating better terms or implementing early payment incentives, they can free up tens of thousands of dollars in working capital without any additional sales.

Financial Forecasting and Modeling

“Where will we be in six months?” This simple question stumps many business owners who lack the tools and expertise to create accurate financial projections.

CFO advisory services include building comprehensive financial models that answer critical questions:

- What happens to profitability if we raise prices by 10%?

- Can we afford to hire three new employees next quarter?

- What revenue level do we need to break even on a new product line?

- How will different economic scenarios impact our business?

These models become invaluable decision-making tools, replacing gut feelings with data-driven insights. They’re particularly crucial when seeking financing, as lenders and investors demand credible financial projections.

Fundraising and Capital Strategy

Whether pursuing bank loans, investor funding, or alternative financing options, raising capital requires expertise that most small business owners simply don’t possess.

A CFO advisor guides the entire fundraising process:

- Determining optimal funding amount and timing

- Preparing investor-ready financial packages

- Valuing your business accurately

- Negotiating terms and understanding implications

- Choosing between debt and equity financing

Many fractional CFOs have existing relationships with lenders, investors, and venture capitalists, opening doors that would otherwise remain closed. Their credibility can significantly increase the likelihood of securing favorable financing terms.

“The best time to raise capital is when you don’t desperately need it. A fractional CFO helps you plan ahead so you’re negotiating from strength, not desperation. Financial Advisory Best Practices, 2025

Profitability Analysis and Cost Optimization

Revenue is vanity, profit is sanity, and cash is reality. Many businesses generate impressive sales figures while barely breaking even because they lack visibility into their true cost structure.

CFO advisory services include deep dive profitability analysis:

- Product/service line profitability: Which offerings actually make money?

- Customer profitability: Are some clients costing more than they’re worth?

- Channel analysis: Which sales channels deliver the best margins?

- Cost structure optimization: Where can expenses be reduced without harming quality?

This analysis often reveals surprising insights. Perhaps that largest customer is actually unprofitable when you factor in the discounts, rush orders, and support they require. Or maybe that “small” product line generates 40% of total profits despite representing only 15% of revenue.

Building Scalable Financial Systems

Rapid growth sounds wonderful until your financial systems collapse under the strain. The processes that worked when you had five employees and $500,000 in revenue become dangerously inadequate at 25 employees and $3 million in revenue.

A fractional CFO implements scalable financial infrastructure:

- Selecting and implementing appropriate accounting software

- Designing chart of accounts for meaningful reporting

- Creating financial dashboards and KPI tracking

- Establishing budgeting and forecasting processes

- Implementing internal controls to prevent fraud

- Building financial policies and procedures

These systems provide the foundation for sustainable growth. They ensure that management has timely, accurate information to make decisions, while also preparing the company for eventual sale, merger, or additional funding rounds.

Integrating these systems with quality bookkeeping services creates a powerful combination accurate historical data combined with strategic forward planning.

Strategic Planning and Decision Support

Should you expand to a second location? Launch that new product? Acquire a competitor? Enter a new market? These decisions can make or break a business, yet they’re often made based on incomplete information and optimistic assumptions.

A CFO advisor brings analytical rigor to strategic decisions:

- Scenario modeling: What are the best case, worst case, and most likely outcomes?

- Break even analysis: What needs to happen for this investment to pay off?

- Risk assessment: What could go wrong, and how can we mitigate those risks?

- Competitive analysis: How do our financial metrics compare to industry benchmarks?

- Return on investment calculations: Which opportunities offer the best returns?

This analytical approach doesn’t eliminate risk entrepreneurship is inherently risky but it ensures you’re taking calculated risks with eyes wide open rather than gambling blindly.

Risk Management and Compliance

The regulatory environment grows more complex every year. Tax laws change, industry regulations evolve, and the penalties for non compliance can be devastating.

CFO advisory services include comprehensive risk management:

- Tax planning and optimization strategies

- Regulatory compliance monitoring

- Insurance coverage analysis

- Fraud prevention and detection

- Contract review for financial implications

- Audit preparation and support

A fractional CFO doesn’t replace your CPA or attorney, but they coordinate with these professionals to ensure nothing falls through the cracks. They think proactively about risks before they become problems.

Preparing for Exit or Succession

Whether planning to sell your business, pass it to family members, or take on a strategic partner, exit planning requires years of preparation not months.

A fractional CFO helps maximize business value:

- Identifying and improving key value drivers

- Cleaning up financial records and documentation

- Optimizing the balance sheet

- Creating recurring revenue streams

- Reducing owner dependency

- Coordinating with M&A advisors and brokers

Business brokers consistently report that companies with clean financials, documented systems, and professional financial management command 20-40% higher valuations than comparable businesses lacking these attributes.

When Should a Small Business Hire a Fractional CFO?

Critical Inflection Points

Certain business situations practically demand CFO advisory expertise:

Rapid growth: Revenue increasing 30%+ annually

Raising capital: Preparing for loans or investor funding

Consistent cash flow challenges: Profitable on paper but always short on cash

Expanding operations: Opening new locations or entering new markets

Major purchases: Considering significant equipment or real estate investments

Merger or acquisition: Buying another company or being acquired

Financial complexity: Multiple entities, international operations, or complex revenue models

Planning for exit: Preparing to sell within 2-5 years

Revenue Thresholds and Business Stages

While every business is unique, general patterns emerge:

$500,000 – $1 million: Usually too early unless pursuing aggressive growth or facing unusual complexity. Focus on solid bookkeeping services first.

$1 million – $3 million: The sweet spot for fractional CFO engagement. Businesses at this stage face increasingly complex decisions but can’t justify a full-time CFO.

$3 million – $10 million: Fractional CFO becomes nearly essential. Financial complexity demands strategic expertise.

$10 million+: May transition to full time CFO, though some businesses maintain fractional arrangements indefinitely if the model works well.

Signs You’ve Outgrown DIY Financial Management

Consider CFO advisory services if you’re experiencing:

- Making major decisions based on gut feeling rather than financial analysis

- Unable to answer “How much cash will we have in 90 days?”

- Surprised by tax bills or cash shortages

- Turning down opportunities due to uncertainty about financial capacity

- Spending significant time on financial tasks instead of core business activities

- Lenders or investors requesting financial information you can’t easily provide

- Lacking confidence in the accuracy of financial reports

- Unable to determine which products/services are actually profitable

The Financial Impact: ROI of Hiring a Fractional CFO

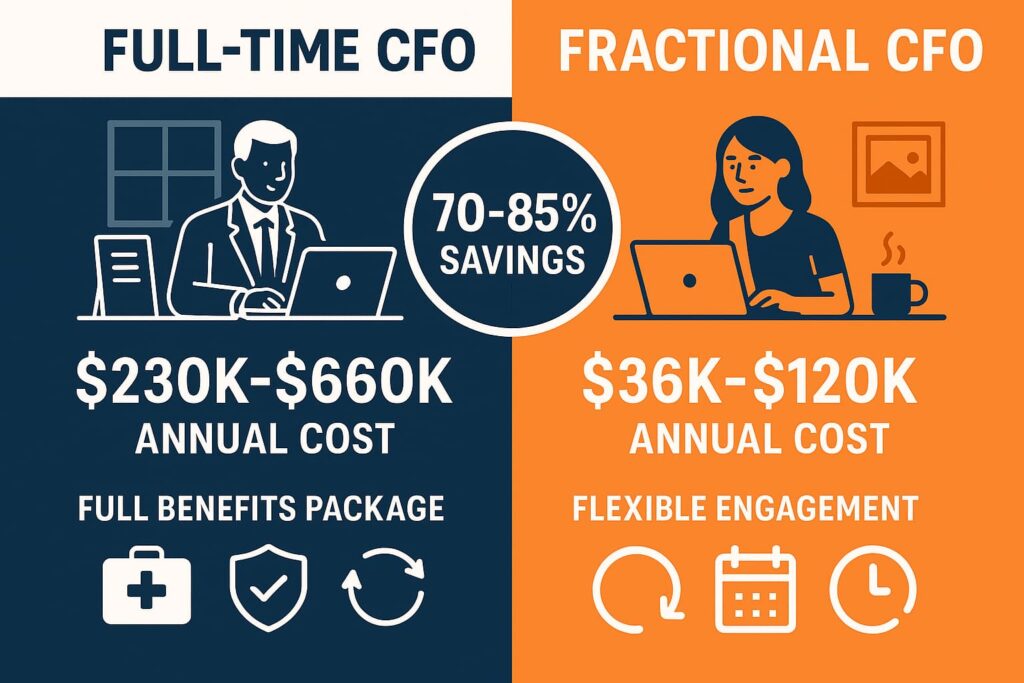

Cost Comparison: Fractional vs. Full-Time CFO

The economics strongly favor the fractional model for most small businesses:

| Expense Category | Full-Time CFO | Fractional CFO |

|---|---|---|

| Base Salary | $150,000 – $400,000 | $0 |

| Benefits (30%) | $45,000 – $120,000 | $0 |

| Bonus/Equity | $20,000 – $100,000 | $0 |

| Recruitment Costs | $15,000 – $40,000 | $0 |

| Annual Total | $230,000 – $660,000 | $36,000 – $120,000 |

| Monthly Cost | $19,000 – $55,000 | $3,000 – $10,000 |

Most small businesses engage fractional CFOs for 8-20 hours monthly, with costs ranging from $3,000-$10,000 per month depending on business complexity and the CFO’s experience level. This represents 70-85% savings compared to full-time employment.

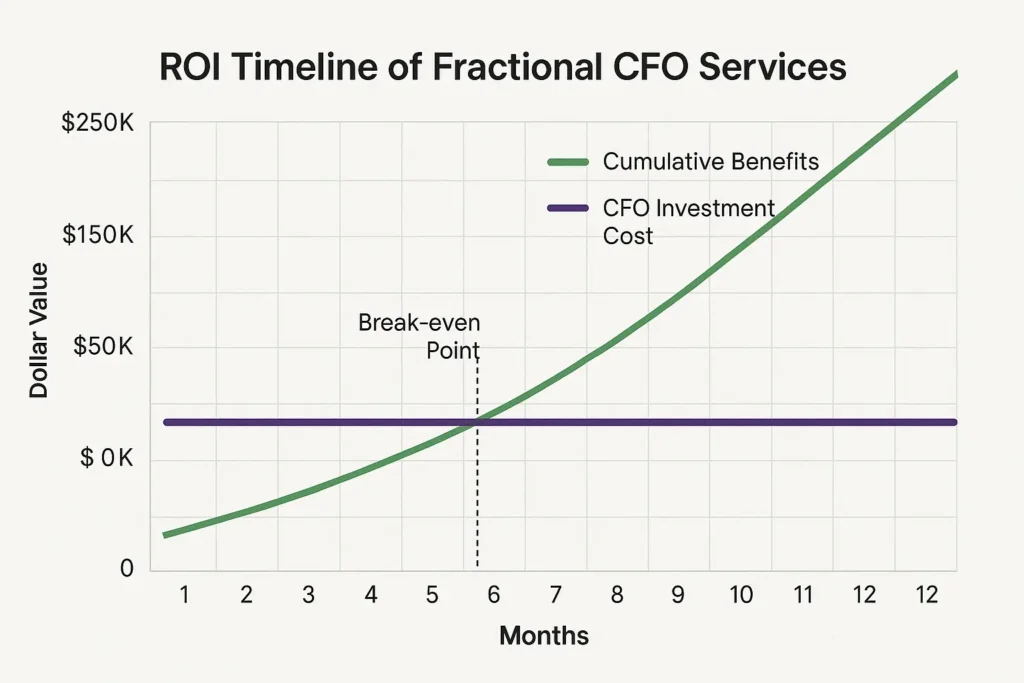

Measurable Benefits and Value Creation

The value delivered by CFO advisory services typically manifests in several measurable ways:

Cash Flow Improvement: Better payment terms, optimized inventory levels, and improved collections often free up 15-30% more working capital within the first six months.

Cost Reduction: Identifying unnecessary expenses, negotiating better vendor terms, and optimizing the cost structure frequently saves 5-15% of operating expenses.

Revenue Enhancement: Pricing optimization, product mix improvements, and identifying high margin opportunities can increase profitability by 10-25% without increasing sales volume.

Financing Success: Businesses working with fractional CFOs secure funding at rates 1-3 percentage points lower than those without professional financial representation, saving thousands annually.

Valuation Increase: Professional financial management, clean records, and documented systems can increase business valuation by 20-40% when it’s time to sell.

Calculating Your Potential ROI

Consider this simplified example:

Business Profile:

- Annual Revenue: $3 million

- Current Net Profit Margin: 8% ($240,000)

- Fractional CFO Cost: $5,000/month ($60,000/year)

Fractional CFO Impact:

- Cash flow optimization frees up $75,000 in working capital

- Cost reduction saves $90,000 annually (3% of revenue)

- Pricing optimization increases margins by 2% ($60,000)

- Total financial benefit: $225,000

Net ROI: $165,000 ($225,000 benefit $60,000 cost) = 275% return on investment

These numbers aren’t hypothetical they represent typical outcomes for businesses that engage qualified CFO advisors.

How Fractional CFOs Work with Existing Accounting Teams

Complementary Roles, Not Replacement

A common misconception is that hiring a fractional CFO means replacing existing accounting services. In reality, these roles complement each other perfectly:

Your Bookkeeper/Accountant:

- Records daily transactions

- Manages accounts payable and receivable

- Reconciles bank accounts

- Prepares financial statements

- Handles payroll processing

- Maintains compliance with tax deadlines

Your Fractional CFO:

- Analyzes the financial statements

- Creates forecasts and budgets

- Develops financial strategy

- Advises on major decisions

- Manages banking relationships

- Leads fundraising efforts

The fractional CFO actually makes your bookkeeper more effective by ensuring they’re tracking the right metrics, using appropriate systems, and providing data in useful formats.

Building an Effective Financial Team

The ideal small business financial team structure includes:

- Bookkeeper or Bookkeeping Service: Handles day to day transaction recording

- Fractional CFO: Provides strategic financial leadership and analysis

- CPA/Tax Accountant: Manages tax preparation and compliance

- Business Owner: Makes final decisions based on CFO recommendations

This team approach delivers enterprise level financial management at small business prices.

Communication and Workflow

Effective fractional CFO engagements typically follow a structured rhythm:

Weekly: Review key metrics, cash position, and urgent issues (30-60 minutes)

Monthly: Deep dive financial review, variance analysis, and strategic discussions (2-4 hours)

Quarterly: Comprehensive business review, planning sessions, and forecast updates (4-8 hours)

Annually: Strategic planning, budgeting, and goal setting (8-16 hours)

Modern technology enables seamless collaboration. Cloud-based accounting systems, shared dashboards, and video conferencing make geography irrelevant your fractional CFO can be across town or across the country.

Selecting the Right Fractional CFO for Your Business

Essential Qualifications and Experience

Not all financial professionals are created equal. When evaluating CFO advisory services, look for:

Educational Background:

- Bachelor’s degree in accounting, finance, or business (minimum)

- MBA or advanced degree (preferred)

- CPA, CMA, or similar professional certification (valuable but not always required)

Professional Experience:

- 10+ years in finance roles

- Prior CFO or controller experience

- Industr specific knowledge (ideally in your sector)

- Track record with businesses at your stage

Technical Skills:

- Proficiency with modern accounting software

- Financial modeling expertise

- Data analysis capabilities

- Understanding of your industry’s metrics

Soft Skills:

- Clear communication abilities

- Teaching and mentoring aptitude

- Strategic thinking

- Problem solving orientation

Industry Specialization Matters

A fractional CFO with experience in your industry brings invaluable context. The financial challenges facing a manufacturing company differ dramatically from those confronting a SaaS startup or professional services firm.

Industry-specific expertise means your CFO advisor understands:

- Relevant benchmarks and KPIs

- Industry specific financing options

- Common pitfalls and challenges

- Regulatory requirements

- Seasonal patterns and business cycles

Questions to Ask Potential CFO Advisors

Before engaging CFO advisory services, conduct thorough interviews:

- What industries and business stages do you specialize in?

- Can you provide references from similar businesses?

- What’s your typical engagement structure and pricing?

- How do you measure success in client relationships?

- What accounting systems and tools do you prefer?

- How will you collaborate with our existing accountant bookkeeper?

- What’s your availability for urgent issues?

- Can you describe a situation where you significantly improved a client’s financial position?

- What financial metrics do you consider most important for businesses like ours?

- How do you stay current with tax law changes and industry developments?

Pay attention not just to the answers, but to how they’re delivered. Your fractional CFO should communicate complex financial concepts in terms you understand not hide behind jargon.

Red Flags to Avoid

Be cautious of fractional CFOs who:

- Lack verifiable experience or references

- Promise unrealistic results

- Can’t explain their methodology clearly

- Seem unfamiliar with modern financial tools

- Don’t ask detailed questions about your business

- Offer suspiciously low rates (you get what you pay for)

- Aren’t transparent about their other clients and time commitments

- Push specific products or services they’re affiliated with

Implementing Fractional CFO Services: What to Expect

The Onboarding Process

Engaging CFO advisory services typically follows a structured implementation:

Week 1-2: Discovery and Assessment

- Review existing financial statements and systems

- Interview key team members

- Identify immediate concerns and opportunities

- Establish communication protocols

Week 3-4: Analysis and Planning

- Deep dive into financial data

- Benchmark against industry standards

- Develop preliminary recommendations

- Create 90 day action plan

Month 2-3: Implementation

- Execute quick win improvements

- Begin building forecasting models

- Implement new reporting systems

- Establish regular review rhythms

Month 4+: Ongoing Partnership

- Regular strategic reviews

- Continuous improvement

- Project based initiatives

- Long term planning

Setting Expectations and Goals

Successful fractional CFO relationships start with clear expectations. Define:

Scope of Work:

- Which responsibilities fall to the CFO vs. existing team?

- What deliverables are expected monthly quarterly?

- How will urgent issues be handled?

Success Metrics:

- What financial improvements are priorities?

- How will progress be measured?

- What timeline is realistic for results?

Communication Standards:

- How often will you meet?

- What reports will be provided?

- How should emergencies be escalated?

Integration with Daily Operations

The best fractional CFOs become true business partners, not just external consultants. They:

- Attend key management meetings

- Participate in strategic planning sessions

- Build relationships with your team

- Serve as a sounding board for major decisions

- Act as an extension of your leadership team

This integration ensures financial considerations inform every business decision, not just accounting matters.

The Future of Fractional CFO Services in 2025 and Beyond

Growing Acceptance and Demand

The fractional executive model has moved from niche to mainstream. In 2025, thousands of businesses will leverage fractional talent not just for CFO roles, but also for CMO, CTO, and other C suite positions.

This trend shows no signs of slowing. Economic uncertainty makes businesses cautious about fixed overhead, while increasing complexity demands expert guidance. CFO advisory services represent the perfect solution flexibility combined with expertise.

Technology Enablement

Advances in financial technology make fractional CFO arrangements more effective than ever:

- Cloud-based accounting systems provide real time access to financial data

- AI powered analytics identify patterns and anomalies automatically

- Automated reporting reduces manual work and improves accuracy

- Collaborative platforms enable seamless communication regardless of location

- Predictive modeling tools enhance forecasting accuracy

These tools amplify the fractional CFO’s impact, allowing them to deliver more value in less time.

Specialization and Niche Expertise

The fractional CFO market is maturing, with increasing specialization. Rather than generalists, businesses can now find CFO advisors with deep expertise in:

- E commerce and direct to consumer brands

- SaaS and technology companies

- Manufacturing and distribution

- Healthcare and medical practices

- Professional services firms

- Franchise operations

- Family owned businesses

- Social enterprises and nonprofits

This specialization means better outcomes, as CFOs bring not just general financial expertise but specific industry knowledge.

Real-World Success Stories

Case Study: Manufacturing Company Turnaround

Situation: A $4.5 million manufacturing company was profitable on paper but constantly struggling with cash flow. The owner was considering a high interest line of credit to cover shortfalls.

Fractional CFO Intervention:

- Analyzed cash conversion cycle and identified 65 day gap between paying suppliers and collecting from customers

- Negotiated extended payment terms with key suppliers

- Implemented early payment discount program for customers

- Optimized inventory levels to free up cash

Results:

- Freed up $180,000 in working capital within 90 days

- Eliminated need for expensive credit line

- Reduced financial stress and enabled growth investments

- ROI: 600% in first year

Case Study: Tech Startup Fundraising Success

Situation: A SaaS startup needed $1.5 million in seed funding but lacked the financial sophistication investors expected.

Fractional CFO Intervention:

- Built comprehensive financial model with multiple scenarios

- Created investor ready pitch deck with financial projections

- Developed unit economics and customer acquisition cost analysis

- Coached founders on financial discussions with investors

Results:

- Successfully raised $2 million (33% more than target)

- Secured favorable terms due to professional presentation

- Established financial systems to manage growth

- Company later acquired for $45 million

Case Study: Retail Business Expansion

Situation: A successful single location retail business wanted to expand to three additional locations but was uncertain about financial feasibility.

Fractional CFO Intervention:

- Created detailed expansion financial model

- Analyzed location specific economics

- Structured financing package combining bank debt and owner equity

- Developed cash flow projections and contingency plans

Results:

- Confidently moved forward with expansion

- All three locations profitable within 18 months

- Revenue grew from $2.1M to $6.8M in three years

- Business owner gained peace of mind and clarity

Taking the Next Step: Is a Fractional CFO Right for You?

Self-Assessment Checklist

Use this checklist to evaluate whether CFO advisory services make sense for your business:

Financial Complexity (Score 1-5 for each):

- Revenue exceeds $1 million annually

- Experiencing rapid growth (20%+ annually)

- Multiple revenue streams or business lines

- Complex cost structure or inventory management

- Seeking or planning to seek outside financing

Strategic Needs (Score 1-5 for each):

- Making major investment decisions

- Planning expansion or new market entry

- Considering acquisition or being acquired

- Preparing for eventual business sale

- Need better financial forecasting and planning

Current Challenges (Score 1-5 for each):

- Cash flow unpredictability

- Lack of confidence in financial reports

- Spending excessive time on financial matters

- Unable to answer investor/lender questions

- Making decisions without financial analysis

Scoring:

- 0-25: Focus on strengthening basic bookkeeping first

- 26-50: Consider fractional CFO within 6-12 months

- 51-75: Strongly recommend fractional CFO engagement now

Starting the Conversation

If you’ve determined that CFO advisory services could benefit your business, take these steps:

- Document your current financial situation and challenges

- Define what success would look like in 6-12 months

- Research fractional CFO providers in your industry

- Schedule consultations with 3-5 potential advisors

- Check references and verify credentials

- Start with a trial engagement (90 days)

- Evaluate results and adjust as needed

Conclusion: Strategic Financial Leadership Within Reach

The question “Why would a small business need a fractional CFO?” has a clear answer: because strategic financial leadership is no longer a luxury reserved for large corporations it’s a competitive necessity for any business serious about sustainable growth.

CFO advisory services bridge the gap between basic accounting compliance and strategic financial management. While comprehensive bookkeeping services ensure your financial records are accurate and compliant, a CFO advisor transforms that data into actionable insights that drive better decisions, improved profitability, and accelerated growth.