Picture this: A promising startup just secured its first major client, revenue is flowing in, and the future looks bright. But six months later, the founder sits surrounded by crumpled receipts, unopened bank statements, and a looming tax deadline. This scenario plays out thousands of times each year, proving that financial success and financial organization are two very different challenges — and that’s where Bookkeeping Services become essential for maintaining clarity, compliance, and control over business finances.

In 2025’s rapidly evolving business landscape, understanding who needs book keeping services has become more critical than ever. Whether you’re a solopreneur juggling multiple responsibilities or managing a growing enterprise, the question isn’t just about needing help it’s about recognizing when professional bookkeeping becomes the difference between sustainable growth and costly chaos.

The reality is stark: according to recent industry data, 82% of small businesses fail due to cash flow problems, many of which stem from poor financial record-keeping. Yet the solution isn’t always obvious. Should you invest in book keeping software? Hire a professional? Or continue managing it yourself?

This comprehensive guide explores exactly who needs bookkeeping services, when to seek professional help, and how to make the smartest decision for your unique situation.

Key Takeaways

- Small business owners with annual revenues exceeding $50,000 typically benefit most from professional book keeping services to ensure accuracy and compliance

- Growing businesses experiencing rapid expansion need robust bookkeeping systems to maintain financial visibility and support strategic decision-making

- Book keeping software can serve as a cost-effective solution for startups and solopreneurs, but requires time investment and financial literacy

- Industry-specific businesses like e-commerce, real estate, and healthcare face unique compliance requirements that often necessitate specialized bookkeeping expertise

- Time-strapped entrepreneurs should calculate their hourly value—if it exceeds the cost of outsourcing, professional services deliver immediate ROI

Understanding Bookkeeping in 2025: More Than Just Number Crunching

Bookkeeping has transformed dramatically from the ledger and pencil days of decades past. Today’s book keeping services encompass a sophisticated blend of technology, regulatory compliance, and strategic financial insight.

What Modern Bookkeeping Actually Involves

At its core, bookkeeping remains the systematic recording of financial transactions. However, the scope has expanded significantly:

- Transaction recording and categorization across multiple platforms and payment systems

- Bank reconciliation to ensure accuracy and detect discrepancies

- Accounts payable and receivable management to maintain healthy cash flow

- Payroll processing with complex tax withholdings and compliance requirements

- Financial reporting that provides actionable business intelligence

- Tax preparation support to maximize deductions and ensure compliance

- Regulatory compliance across local, state, and federal requirements

The modern bookkeeper serves as both historian and forecaster, maintaining accurate records while providing insights that drive business decisions.

Small Business Owners: The Primary Beneficiaries 💼

Small business owners represent the largest group who benefit from professional book keeping services. But what defines a small business that truly needs these services?

Revenue Thresholds That Signal the Need

While every business is unique, certain financial milestones typically indicate when DIY bookkeeping becomes counterproductive:

| Annual Revenue | Recommended Approach | Rationale |

|---|---|---|

| Under $50,000 | Book keeping software with occasional professional review | Cost-effective for simple transactions |

| $50,000-$250,000 | Part-time bookkeeper or monthly service | Growing complexity requires expertise |

| $250,000-$1M | Dedicated bookkeeper (in-house or outsourced) | Transaction volume demands consistent attention |

| Over $1M | Full accounting team with controller | Strategic financial management becomes critical |

The Solo Entrepreneur’s Dilemma

Sarah, a graphic designer who launched her freelance business in 2023, initially managed her finances with a simple spreadsheet. As her client roster grew to fifteen regular accounts, she found herself spending 10+ hours monthly on bookkeeping time she could have spent earning $75 per hour designing.

Her breaking point came during tax season when her accountant discovered $12,000 in missed deductions and $3,000 in incorrectly categorized expenses. The cost of professional bookkeeping services for small businesses would have been $300 monthly a fraction of what she lost.

Solo entrepreneurs need bookkeeping services when:

- Client numbers exceed 5-10 regular accounts

- Multiple income streams create categorization complexity

- Time spent on bookkeeping exceeds 5 hours monthly

- Tax planning becomes more sophisticated

- Growth goals require financial forecasting

E-Commerce and Online Businesses: Unique Complexity 🛒

The explosive growth of e-commerce has created a distinct category of businesses with specialized bookkeeping needs. Online retailers face challenges that traditional brick-and-mortar stores never encountered.

Why E-Commerce Bookkeeping Differs

E-commerce businesses deal with:

- Multi-channel sales across platforms like Amazon, Shopify, Etsy, and proprietary websites

- Complex fee structures with platform fees, payment processing fees, and shipping costs

- Inventory management requiring cost of goods sold (COGS) tracking

- Sales tax nexus complications across multiple states or countries

- High transaction volumes that overwhelm basic book keeping software

- Returns and refunds that complicate revenue recognition

Consider Marcus, who runs a successful Amazon FBA business. With 200+ daily transactions, fees deducted automatically, inventory stored in multiple warehouses, and sales tax obligations in 43 states, his bookkeeping requirements far exceed what general book keeping software can handle efficiently.

The Integration Challenge

Modern e-commerce businesses often require bookkeeping systems that integrate with:

- Shopping cart platforms

- Payment processors (PayPal, Stripe, Square)

- Inventory management systems

- Shipping software

- Marketing platforms for accurate customer acquisition costs

E-commerce businesses need specialized book keeping services when:

✅ Monthly transactions exceed 500

✅ Selling across multiple platforms

✅ Managing inventory with COGS tracking

✅ Facing sales tax obligations in multiple jurisdictions

✅ Seeking to calculate true profitability per product or channel

Service-Based Businesses: Time Tracking Meets Financial Tracking ⏰

Consultants, agencies, law firms, and other service-based businesses face their own unique bookkeeping challenges, primarily centered around time tracking, project profitability, and client billing.

The Billable Hour Equation

Service businesses must track not just income and expenses, but also:

- Time allocation across clients and projects

- Project profitability to identify profitable vs. loss-making engagements

- Work-in-progress (WIP) for accurate revenue recognition

- Retainer management and trust accounting

- Subcontractor payments and 1099 compliance

Jennifer’s marketing agency grew from 2 to 15 employees in eighteen months. Her basic book keeping software could track invoices and expenses, but couldn’t answer critical questions: Which clients were most profitable? Were certain service offerings losing money? How much unbilled work existed?

After implementing professional book keeping services with project accounting capabilities, she discovered that 30% of her clients generated minimal profit after accounting for team time insights that transformed her business model.

Professional Services Compliance

Certain service industries face additional regulatory requirements:

- Law firms must maintain trust accounts with strict compliance rules

- Healthcare providers need HIPAA-compliant systems

- Financial advisors require detailed audit trails

- Government contractors must follow FAR compliance standards

For these professionals, exploring bookkeeping tips every small business can benefit from becomes essential for maintaining both profitability and compliance.

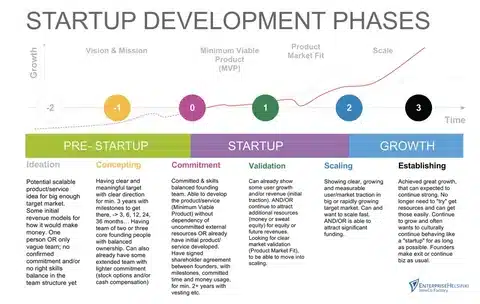

Growing Businesses: Scaling Beyond the Startup Phase 📈

Perhaps no group needs professional book keeping services more urgently than businesses experiencing rapid growth. Ironically, success often creates the very chaos that threatens sustainability.

The Growth Paradox

Fast-growing businesses face a unique challenge: the systems that worked at $100K annual revenue collapse at $500K, and what functioned at $500K fails catastrophically at $2M.

Warning signs that growth has outpaced your bookkeeping:

- Cash flow surprises despite profitable operations

- Inability to quickly answer basic financial questions

- Delayed financial statements (receiving reports 30+ days after month-end)

- Missed payment deadlines or late fees becoming common

- Declining profit margins without clear understanding why

- Maxed credit lines despite strong sales

- Tax filing extensions becoming the norm rather than exception

The Cost of Inadequate Systems

A technology startup that grew from 5 to 50 employees in one year discovered during their Series A fundraising that their financial statements contained significant errors. Investors delayed funding for three months while auditors reconstructed accurate financials a delay that cost the company a key partnership and nearly derailed the entire round.

The founders had relied on entry level book keeping software and a part-time bookkeeper who lacked experience with venture-backed companies. The cost of proper bookkeeping would have been $3,000 monthly; the delayed funding cost them an estimated $500,000 in lost opportunities.

Businesses With Employees: Payroll Complexity Multiplied 👥

The decision to hire employees fundamentally changes bookkeeping requirements. Payroll introduces layers of complexity that even sophisticated book keeping software struggles to manage without expertise.

Payroll Compliance Requirements

Employers must navigate:

- Federal tax withholdings (income tax, Social Security, Medicare)

- State and local taxes varying by jurisdiction

- Unemployment insurance (FUTA and SUTA)

- Workers’ compensation insurance and reporting

- Benefits administration (health insurance, retirement plans, FSAs)

- Garnishments and child support orders

- Multi-state compliance for remote workers

- Contractor vs. employee classification

The penalties for payroll errors are severe. The IRS assesses failure-to-deposit penalties ranging from 2% to 15% of unpaid amounts, plus interest. Misclassifying employees as contractors can result in back taxes, penalties, and legal liability.

Beyond Basic Payroll

Sophisticated businesses need bookkeeping that connects payroll to:

- Job costing for project-based work

- Department allocation for accurate P&L by division

- Benefits accounting for true labor cost calculation

- Accrued vacation and sick time tracking

- Bonus and commission calculations

Businesses with employees need professional book keeping services when:

- Employing 3+ people (complexity increases exponentially)

- Operating in multiple states

- Offering benefits packages

- Using contractors alongside employees

- Needing job or project costing

Real Estate Investors and Property Managers 🏘️

Real estate presents some of the most complex bookkeeping challenges across any industry, combining property-level accounting, investor reporting, and specialized tax considerations.

Property-Level Accounting Needs

Real estate investors and property managers must track:

- Income by property (rent, late fees, parking, amenities)

- Operating expenses categorized for tax optimization

- Capital improvements vs. repairs and maintenance

- Depreciation schedules for multiple properties and components

- Tenant deposits in segregated accounts

- Mortgage principal and interest allocation

- Property tax payments and assessments

- 1031 exchange documentation

A property manager overseeing 50 rental units needs to produce monthly statements for each property owner, track security deposits in compliance with state law, categorize expenses correctly for tax purposes, and maintain audit trails for potential disputes.

Investor Reporting Requirements

Property managers serving multiple investors face additional demands:

- Monthly or quarterly owner statements

- Capital call tracking for syndications

- Distribution calculations and payments

- K-1 preparation support

- Waterfall distribution modeling

Standard book keeping software rarely handles these requirements without extensive customization. Specialized real estate bookkeeping services become not just helpful but essential for compliance and investor relations.

Franchisees: Dual Reporting Obligations 🍔

Franchise owners occupy a unique position requiring bookkeeping that satisfies both franchisor requirements and their own business management needs.

Franchisor Reporting Requirements

Most franchisors mandate:

- Weekly or monthly sales reports for royalty calculation

- Specific chart of accounts structures

- Advertising fund contributions tracking

- Approved vendors and pricing compliance

- Inventory management following brand standards

- Labor cost percentages meeting brand benchmarks

Simultaneously, franchisees need financial information to manage their own profitability, cash flow, and growth decisions.

Maria owns three quick-service restaurant franchises. Her franchisor requires weekly sales reports by 9 AM every Monday, monthly financial statements using their prescribed format, and quarterly business reviews with detailed variance analysis. She also needs to manage cash flow across three locations, plan for equipment replacement, and evaluate whether to open a fourth location.

Her book keeping software connects to her point-of-sale systems, automatically generates franchisor reports, and provides the multi-location visibility she needs for strategic decisions but only because she works with bookkeepers who understand franchise-specific requirements.

Accountants and Financial Professionals: When the Experts Need Support 📊

Ironically, many accountants and financial professionals themselves benefit from outsourcing bookkeeping functions, allowing them to focus on higher value advisory services.

The Advisory Shift

The accounting profession has undergone a fundamental transformation. CPAs and chartered accountants increasingly position themselves as strategic advisors rather than compliance processors. This shift creates a dilemma: clients still need bookkeeping, but professionals want to spend time on:

- Tax planning and strategy

- Financial forecasting and modeling

- Business advisory services

- Succession planning

- M&A support

Many accounting firms now outsource routine bookkeeping to specialized providers, using book keeping services as a foundation for their higher-margin advisory work.

The Capacity Challenge

A CPA firm with 200 clients faces a choice: hire bookkeepers in-house (with recruitment, training, and management overhead) or partner with bookkeeping services that handle the routine work while the CPAs focus on tax strategy and advisory.

Progressive firms are choosing the latter, recognizing that their professionals’ time is most valuable when applied to complex problem-solving, not transaction categorization.

Nonprofit Organizations: Mission-Driven with Compliance Demands 🤝

Nonprofits face unique bookkeeping requirements that blend business accounting with fund accounting, donor restrictions, and heightened transparency obligations.

Fund Accounting Complexity

Unlike for-profit businesses, nonprofits must track:

- Restricted vs. unrestricted funds with strict separation

- Grant compliance and reporting requirements

- Donor restrictions on specific contributions

- Program vs. administrative expenses for Form 990

- In-kind donations valuation and recording

- Endowment management and spending policies

The consequences of bookkeeping errors in nonprofits extend beyond financial penalties. Donor trust, grant eligibility, and tax-exempt status can all be jeopardized by inadequate financial management.

Transparency and Accountability

Nonprofits operate under public scrutiny, with Form 990 filings available for anyone to review. Professional book keeping services help ensure:

- Accurate program expense allocation

- Proper grant accounting and reporting

- Board-ready financial statements

- Audit preparation and support

- Donor confidence through transparency

A community foundation managing $5 million in assets across 30 restricted funds discovered during an audit that $200,000 had been spent from restricted funds without proper documentation. The resulting donor relations crisis and legal fees far exceeded what professional bookkeeping would have cost.

Seasonal Businesses: Managing Feast and Famine 🌞❄️

Businesses with significant seasonal fluctuations landscaping, tax preparation, tourism, retail face cash flow and forecasting challenges that make professional bookkeeping particularly valuable.

The Cash Flow Rollercoaster

Seasonal businesses must:

- Manage cash reserves during slow periods

- Plan for tax payments when revenue is irregular

- Forecast accurately despite variable income

- Budget for annual expenses with seasonal cash flow

- Maintain year-round staffing or manage hiring/layoff cycles

A landscaping company generates 80% of annual revenue between April and October. The owner must ensure enough cash remains after the busy season to cover winter expenses, make quarterly tax payments, purchase equipment, and maintain key employees year-round.

Without accurate bookkeeping and cash flow forecasting, seasonal businesses often find themselves profitable on paper but unable to pay bills during slow months. Professional book keeping services provide the visibility and planning tools to smooth the seasonal rollercoaster.

When Book Keeping Software Is Enough (And When It Isn’t) 💻

Book keeping software has revolutionized financial management for small businesses, offering powerful capabilities at affordable prices. But software alone isn’t always the answer.

The Software-Only Approach Works When:

- Transaction volume remains under 100 monthly

- Business model is straightforward (single revenue stream, simple expenses)

- Owner has basic accounting knowledge

- Time is available for weekly bookkeeping (2-4 hours)

- No employees or simple payroll only

- Industry has minimal specialized compliance requirements

Popular platforms like QuickBooks Online, Xero, and FreshBooks provide robust features including:

- Bank feed integration

- Invoice creation and tracking

- Expense categorization

- Basic reporting

- Receipt capture

- Mileage tracking

When Software Needs Human Expertise:

Even the best book keeping software has limitations:

- Cannot make judgment calls about transaction categorization

- Doesn’t understand industry-specific requirements

- Won’t catch errors without human review

- Can’t provide strategic insights from the data

- Requires accounting knowledge to set up correctly

- Demands regular time investment that busy owners lack

The hybrid approach book keeping software managed by professional bookkeepers combines technology efficiency with human expertise. This model has become the gold standard for businesses with $100K-$5M in annual revenue.

For more insights on optimizing your approach, the BooksOnTime blog offers regular updates on bookkeeping best practices and technology.

The True Cost of DIY Bookkeeping: A Reality Check 💰

Many business owners initially handle bookkeeping themselves to save money. But is DIY actually more cost-effective?

The Opportunity Cost Calculation

Consider this framework:

Your Hourly Value = Annual target income ÷ 2,000 hours (typical work year)

If you target $100,000 annually, your time is worth $50/hour. If you spend 10 hours monthly on bookkeeping, that’s $500 in opportunity cost likely more than professional services would cost.

Hidden Costs of DIY Bookkeeping:

Beyond opportunity cost, DIY bookkeeping often incurs:

- Missed tax deductions (averaging $3,000-$8,000 annually for small businesses)

- Late payment penalties and interest charges

- Tax penalties for errors or missed deadlines

- Higher accountant fees to clean up messy books during tax season

- Poor financial decisions based on incomplete or inaccurate information

- Stress and anxiety around financial management

- Growth limitations from lack of financial visibility

When DIY Makes Sense:

DIY bookkeeping can work during:

- Pre-revenue startup phase with minimal transactions

- Very simple business models (single client, straightforward billing)

- Personal financial management for W-2 employees with side income

But most businesses outgrow DIY within 6-18 months of operation.

Industry-Specific Considerations: One Size Doesn’t Fit All 🏭

Certain industries face unique bookkeeping challenges that require specialized knowledge:

Construction and Contractors

- Job costing and work-in-progress tracking

- Retainage accounting

- Progress billing and AIA forms

- Certified payroll for prevailing wage projects

- Subcontractor management and lien waivers

- Equipment depreciation and section 179 deductions

Healthcare and Medical Practices

- Insurance billing and accounts receivable aging

- HIPAA-compliant systems

- Credentialing and payer contract tracking

- Medical supply inventory

- Multiple provider compensation models

Restaurants and Food Service

- High-volume, low-margin transactions

- Inventory management with spoilage

- Tip reporting and pooling

- Labor cost percentage monitoring

- Multi-location consolidation

Professional Services (Law, Consulting, Engineering)

- Trust accounting (for attorneys)

- Project-based profitability

- Time and billing integration

- Retainer management

- Multiple partner/shareholder distributions

Each industry benefits from bookkeepers who understand its unique requirements, terminology, and best practices.

The Transition Point: Recognizing When You Need Help 🚦

Most businesses don’t wake up one day and decide they need book keeping services. Instead, warning signs accumulate until the need becomes undeniable.

Red Flags That Demand Action:

You can’t quickly answer basic questions like “What was our revenue last month?” or “How much cash do we have?”

Tax deadlines create panic rather than being routine events

Bank reconciliations are months behind (or never done)

You’re making business decisions without financial data or based on gut feeling alone

Bookkeeping tasks keep getting postponed because they feel overwhelming

You’ve received IRS or state tax notices for missed payments or filings

Your accountant spends hours cleaning up your books before tax preparation

You can’t get financing because your financial statements aren’t reliable

You’re profitable but always short on cash without understanding why

The Tipping Point

For most businesses, the tipping point occurs when:

- Annual revenue exceeds $100,000

- Monthly transactions exceed 50-100

- Employees are hired

- Multiple revenue streams develop

- Growth accelerates beyond 20% annually

- Complexity increases (multiple locations, products, or services)

Waiting too long to get professional help creates a more expensive cleanup project than implementing proper systems from the start.

Making the Decision: Software, Service, or Both? 🤔

The bookkeeping solution that’s right for your business depends on multiple factors. Here’s a decision framework:

Decision Matrix

Choose book keeping software alone if:

- Annual revenue under $50,000

- Simple business model

- Under 50 monthly transactions

- No employees

- Owner has accounting knowledge and available time

- Minimal industry-specific requirements

Choose professional book keeping services if:

- Annual revenue over $250,000

- Complex business model

- Over 200 monthly transactions

- Multiple employees

- Industry-specific compliance needs

- Owner time better spent on revenue-generating activities

Choose hybrid approach (software + professional services) if:

- Annual revenue $50,000-$250,000

- Moderate complexity

- 50-200 monthly transactions

- 1-10 employees

- Growing business needing scalability

- Desire for technology efficiency with expert oversight

Questions to Ask Potential Bookkeeping Services:

When evaluating book keeping services, ask:

- What industries do you specialize in?

- What software platforms do you use?

- How often will I receive financial statements?

- What’s your process for handling questions?

- How do you ensure data security?

- What’s included in your base service vs. add-ons?

- Can you provide references from similar businesses?

- How do you handle tax preparation coordination?

- What’s your average client retention rate?

- How will you help me understand my financial statements?

The ROI of Professional Bookkeeping: Quantifying the Value 📊

Professional book keeping services deliver return on investment through multiple channels:

Direct Financial Returns:

- Tax savings from maximized deductions and credits ($3,000-$15,000+ annually)

- Avoided penalties for late filings or payments ($500-$5,000+ annually)

- Better vendor terms through timely payment and good relationships

- Reduced accounting fees from organized records at tax time

- Lower interest costs through improved cash flow management

Indirect Value Creation:

- Better business decisions from accurate, timely financial information

- Improved profitability from identifying unprofitable products, services, or clients

- Faster growth enabled by financial visibility and planning

- Reduced stress and improved work-life balance

- Increased business value for eventual sale or succession

- Easier financing through reliable financial statements

Calculating Your ROI:

A business paying $500 monthly for professional bookkeeping ($6,000 annually) might realize:

- $5,000 in additional tax savings

- $2,000 in avoided penalties

- $3,000 in reduced year-end accounting fees

- 10 hours monthly saved × $75/hour × 12 months = $9,000 opportunity value

Total value: $19,000 on a $6,000 investment = 217% ROI

This doesn’t account for better decisions, reduced stress, or growth enablement all significant but harder to quantify.

The Future of Bookkeeping: Trends Shaping 2025 and Beyond 🔮

The bookkeeping landscape continues to evolve rapidly, with several trends reshaping how businesses manage their finances:

Artificial Intelligence and Automation

Modern book keeping software increasingly incorporates AI to:

- Auto-categorize transactions with improving accuracy

- Detect anomalies and potential errors

- Predict cash flow based on historical patterns

- Suggest tax deductions based on spending patterns

- Automate reconciliation processes

However, AI augments rather than replaces human bookkeepers. The judgment, industry knowledge, and strategic insight that professionals provide remain irreplaceable.

Real-Time Financial Visibility

Cloud-based systems enable business owners to access financial data anytime, anywhere. This real-time visibility transforms decision-making, allowing:

- Instant profitability analysis by product, service, or customer

- Daily cash position monitoring

- Immediate expense approval workflows

- Live dashboard access for key metrics

Integration Ecosystems

Modern businesses use dozens of software tools. Leading book keeping services now offer integration with:

- E-commerce platforms (Shopify, Amazon, WooCommerce)

- Payment processors (Stripe, PayPal, Square)

- Point-of-sale systems

- Inventory management software

- Time tracking tools

- CRM systems

- Project management platforms

These integrations eliminate duplicate data entry and ensure accuracy across systems.

Advisory Services Evolution

Bookkeeping is shifting from pure compliance to strategic advisory. Forward-thinking providers offer:

- Fractional CFO services for strategic planning

- KPI dashboards tailored to your industry

- Scenario modeling for business decisions

- Profitability optimization consulting

- Cash flow forecasting and management

This evolution means businesses can access CFO-level insights without CFO-level costs.

Common Mistakes When Choosing Bookkeeping Solutions ⚠️

Avoiding these common pitfalls can save significant time, money, and frustration:

Mistake #1: Choosing Based on Price Alone

The cheapest option often proves most expensive when errors, missed deductions, or inadequate service create larger problems. Value and expertise matter more than bottom-line cost.

Mistake #2: Waiting Until Tax Season

Scrambling to organize a year’s worth of transactions in March creates stress, errors, and missed planning opportunities. Professional bookkeeping provides year-round value, not just tax preparation.

Mistake #3: Assuming All Bookkeepers Are Alike

Bookkeeping expertise varies dramatically. Industry specialization, technology proficiency, and communication skills all impact the value you receive. Interview multiple providers and check references.

Mistake #4: Failing to Integrate Systems

Choosing book keeping software that doesn’t integrate with your other business tools creates duplicate work and potential errors. Prioritize integration capabilities.

Mistake #5: Not Establishing Clear Communication

Successful bookkeeping relationships require clear expectations around:

- Frequency of financial statements

- Response time for questions

- Who handles what tasks

- How information is shared

- What’s included vs. additional fees

Document these expectations upfront to avoid misunderstandings.

Mistake #6: Ignoring Data Security

Financial data is sensitive. Ensure your bookkeeping provider has:

- Secure data transmission and storage

- Regular backups

- Access controls and authentication

- Cyber liability insurance

- Clear data ownership policies

Taking Action: Your Next Steps 🚀

Understanding who needs book keeping services is only the first step. Implementation requires deliberate action.

Immediate Actions (This Week):

- Assess your current state using the calculator above

- Calculate your opportunity cost honestly

- Research 3-5 bookkeeping solutions appropriate for your needs

- Schedule consultations with top candidates

- Review your current financial records to understand cleanup needs

Short-Term Actions (This Month):

- Make a decision on your bookkeeping approach

- Implement chosen solution with clear timeline

- Establish routines for document sharing and communication

- Set up integrations between systems

- Schedule regular financial reviews (weekly or monthly)

Long-Term Strategy (This Quarter):

- Develop financial literacy to understand your reports

- Create financial goals and tracking mechanisms

- Build cash reserves based on bookkeeping insights

- Optimize tax strategy with professional guidance

- Plan for growth using accurate financial forecasting

Conclusion: Investing in Financial Clarity

The question “Who needs bookkeeping services?” has a deceptively simple answer: virtually every business that wants to grow sustainably and profitably.

Whether you’re a solo entrepreneur just starting out, a small business owner managing growth, or a financial professional seeking to optimize your practice, quality bookkeeping forms the foundation of sound business management.

The specific solution DIY with book keeping software, hybrid professional services, or full-service bookkeeping—depends on your unique circumstances. But the need for accurate, timely financial information is universal.

In 2025’s competitive business environment, flying blind financially is not just risky it’s potentially fatal to your business. The businesses that thrive are those that:

✅ Recognize bookkeeping as an investment, not an expense

✅ Prioritize financial visibility for better decision-making

✅ Leverage technology while valuing human expertise

✅ Act proactively rather than reactively on financial management

✅ View bookkeeping as strategic rather than merely compliance-focused

The cost of professional book keeping services pales in comparison to the cost of poor financial management: missed opportunities, tax penalties, cash flow crises, and stunted growth.

Your business deserves the financial clarity that quality bookkeeping provides. The only question remaining is: when will you make it a priority?

Take the first step today. Assess your needs, explore your options, and commit to the financial foundation that will support your business growth for years to come. Your future self—and your business—will thank you.